R: Machine Learning Triangles#

This article was originally created by Grainne McGuire and Jacky Poon and published in the General Insurance Machine Learning for Reserving Working Party (“MLR-WP”) blog. The MLR-WP is an international research group on machine learning techniques to reserving, with over 50 actuaries from around the globe. The goal of the group is to bring machine learning techniques into widespread adoption ‘on the ground’ by identifying what the barriers are, communicating any benefits, and helping develop the research techniques in pragmatic ways. Whilst some articles have been brought into this cookbook, consider exploring the blog further for additional content including detailed walkthroughs of more advanced models.

Introduction#

In this article we look at applying different machine learning (ML) models to a data set. Our goal is to illustrate a work flow for:

setting up a data set for ML

applying different ML models to this data

tuning the ML hyper-parameters

comparing and contrasting performance for the past fitted values and the future predictions.

A secondary goal is to demonstrate the utility of a multi-model machine learning framework which enables the user to easily “plug and play” different machine learning models within the same framework. We use the mlr3 set of packages in R here - this and other similar packages in R (e.g. caret and tidymodels) and tools in scikit-learn in python may be useful in creating a smoother work flow.

A [notebook version of this article](/mlr-blog/f_notebooks/ML modelling on triangles - a worked example.html) is also available which may be helpful if you want to experiment with this code.

Who is this article aimed at?#

This article is aimed at those who know a little about some of the standard machine learning models, but who may not have done much hands-on work with an analysis. It will also be useful for those who have done some experimentation, but maybe not on a reserving data set. Finally, it may also be of interest to R users who have never used a multi-model framework before and who would like to see how the mlr3 ecosystem works.

Pre-requisites to this article#

We’ve tried to make this article accessible to people new to ML, and to make this article stand-alone. Having some knowledge about basic machine learning techniques like decision trees, random forests and XGBoost (gradient boosting) will help. Furthermore, we also fit the Chainladder model as a GLM (sometimes referred to as a Stochastic Chainladder) and fit a particular type of LASSO model. We’ve included limited details on these models here - our previous blog posts have more details on these:

The data set#

Our example deals with using ML to set reserves for a single aggregate 40x40 triangle. We’ve selected the data set because:

It’s small, so the code will run relatively quickly on your machine - there’s nothing worse than running through a worked example and having to wait hours for results!

A lot of reserving is still done using traditional accident (or underwriting) + development aggregated triangles so it is relevant to the real world.

We use a simulated data set. There are several reasons for this:

We know the future results so can examine how different reserve predictions perform.

We can control how the future experience emerges. In particular, we can ensure there are no future systemic changes (e.g. from legislation or court precedent) that would impact future payments. Changes like this can make it difficult when examining performance of reserve prediction methods on real data - it can be hard to separate poor performance of the model from a good model where the future experience departs markedly from that used to build the model.

We can share the data set (and the code to generate it) with you.

The data set used is simulated data set 3 from the paper Self-assembling insurance claim models using regularized regression and machine learning. This is a 40x40 triangle of incremental quarterly payments over 10 years. Variables on the data set are accident, development and calendar quarters only. A copy of the data set is available here.

Machine learning and aggregate triangles#

Typically, ML and big data go hand-in-hand. By big data we mean lots of observations and lots of features (covariates / independent variables / regressors). Aggregate triangles are small in both senses - small numbers of observations and limited features (often just the 3 time features of accident/underwriting period, development period and calendar period).

This is not to say that it is invalid to use machine learning for aggregate triangles - many people have demonstrated good results from machine learning for such data - there are many papers on this topic. But it’s also true that an experienced actuary using a Chainladder model (or other traditional) method, overlaid with judgement, will often get a similar answer to the best ML method, even for a complex triangle. However ML may be a more efficient way of getting to an answer. In the worked example below, we use a data set which deviates significantly from Chainladder assumptions. Therefore the unadjusted Chainladder projection is quite poor and would need a significant investment of time to yield a better model. In contrast, the better performing ML models we looked at have a better first estimate, so may not require as much intervention to produce a final estimate, thereby leading to a time-saving.

Don’t rank the ML models used based on this example#

The purpose of this article is to demonstrate a workflow for fitting ML models in R. While we’ve done some work to improve model fitting, there are a lot more things we would consider if we were looking for the best models (e.g. feature engineering, train/test splits, performance measures). So, although we do look at the relative performance of the different models at the end, you should not make any conclusions about the relative performance of the different ML methods based on this work.

You may find that by adjusting some hyper-parameters, or by revising the training/test data set split, you’re able to find better models. We’ll be discussing this point a bit further at the end of the article.

A priori, given the form of the data (simulated using a regression style structure) and that the LASSO model we used is based on previous work which did aim to establish a framework to fit good models to triangular data using the LASSO, we expected that the LASSO model would perform the best and (spoiler alert!) it did.

mlr3 package#

One problem with applying many different types of ML models is that they all generally have different input specifications for the data, and different output types. This can make it a bit tedious to try several models.

There are a number of ML aggregator or multi-model packages that do a lot of the data manipulation behind the scenes. These packages take in data in a specified form and allow users to call the different ML methods. They abstract away any data manipulation required to put the data into the form required by the method. The benefit of these is apparent - set up the data in the aggregator and then switch models in and out at will.

One of our previous articles covers multi-model packages.

Some ML aggregators in R include

tidymodels - a successor to caret.

mlr3 is the successor to the popular but no longer actively developed mlr.

The Python package scikit-learn also provides a lot of useful machine learning tools.

If you’re looking to use an aggregator package then it’s probably best to read up on a few of them, then select the one that best works for you. We picked mlr3 first because one of us has used mlr in the past and second we are part of the Machine Learning in Reserving working party, so we had to give mlr3 a try!

mlr3 uses the R6 object orientated classes - R6 is similar to object orientated programming in other languages such as Python or C++, but is quite different to R’s S3 and S4 object orientated approaches. So, depending on your programming experience, the syntax may take a bit of getting used to.

As a rough rule of thumb, when working with R6 classes we:

First set up an instance of the class. Note that the class can contain both methods (like functions) and data.

We then run methods for the class object. These may update the data in the object.

We can view and use the data in the class object. Sometimes we can edit the data directory, othertimes, the data is read only and can only be modified using a method (function) available in the class object.

If you want to learn more there is plenty of documentation out there:

When using mlr3 code, then you can get inline help in R by using the help() method in a class object. This will bring you to help pages.

E.g. lrn("regr.rpart")$help() with get you help on decision tree learners and the learner object in general.

In our worked example below, we aim to explain each step clearly, so if you prefer to use another package (or language) or work separately with the individual ML packages, you should be able to translate what we are doing into code that is more familiar to you.

ML methods used#

We’ve looked at the following methods:

Decision trees

Random forests

XGBoost

LASSO

We also use a GLM which is set up to replicate the Chainladder estimates (refer to this post for more details).

An obvious omission from here are neural networks / deep learning models. We’ve omitted these for a couple of reasons:

We’re using mlr3 here. While there is a mlr3keras package, the developers state (as of May 2021) that mlr3keras is in very early stages, and currently under development. Functionality is therefore experimental and we do not guarantee correctness, safety or stability.

The setup for mlr3keras is more difficult as it requires having an instance of Python running on your system. R’s reticulate package then interfaces between the two. Sometimes this is straightforward (some recent improvements have made this a lot easier), but other times it can be frustrating.

However, we are actively looking at using deep learning models and will be revisiting them in the near future.

Outline of the workflow#

The workflow we have set up consists of the following:

Prepare the data for use in the models, including train and test partitions (past data) and hold-out or validation partitions (future data).

Fit each of the models selected. For each of these we:

Select hyper-parameters (these control the model-fitting process) for tuning

Tune the hyper-parameters using the train and test partitions and select the set of values that yield the best results

Calculate predicted values on the holdout (future) data.

Run diagnostics on the predicted values for each model and look at the reserve estimates.

We’ll now work through each of the stages below.

Setup#

The first step is to load all the libraries required for this work (and install them first if needed). We’ve included details of our session which includes versions of the packages we used at the end of this article. If you are having problems running our code, check that your packages (the mlr3 ones in particular) are the same as ours.

Note that mlr3 is actually a collection of a number of different packages. If you want to do a specific task, it’s worth seeing if there is an mlr3 package out there for it. There are a number of core mlr3 packages which are hosted on CRAN. We’ve attached them separately here to make it clear which ones we are using but it is also possible to install and attach the most commonly used ones via the mlr3verse wrapper package.

Some of the accompanying packages are on github only. Of these, we’re just going to use one here - mlr3extralearners - which contains an extended set of machine learning models (the CRAN package mlr3learners includes the most common ones). Install this using the remotes package - the code is given below in the comments.

You also need to have the following packages installed - but you do not need to attach them as a library:

glmnet (for the LASSO model)

rpart (decision tree)

ranger (random forest)

xgboost

viridis (colour schemes used in some of the plots).

Finally you need to install mlr3measures but you must not attach it (i.e. use library(mlr3measures)) as this will lead to code errors.

The code below checks for these packages and will give you a warning message if you are missing any of them. You can then install them (with the exception of mlr3extralearners) with install.packages() or, for RStudio users, via the Packages tab.

reqd_packages <- c("data.table",

"ggplot2",

"glmnet",

"kableExtra",

"IRdisplay",

"mlr3",

"mlr3extralearners",

"mlr3learners",

"mlr3measures",

"mlr3tuning",

"paradox",

"patchwork",

"ranger",

"remotes",

"rpart",

"rpart.plot",

"viridis",

"xgboost")

for (p in reqd_packages){

check_p <- requireNamespace(p, quietly = TRUE)

if (!check_p) warning(paste("Install the package", p, "before continuing\n"))

}

message("Package checking complete\n")

# To install packages via code:

# install.packages(<package name>)

# To install mlr3extralearners (which is not on CRAN so must be installed on github)

# 1. Ensure you have the remotes package installed

# 2. install using

# remotes::install_github("mlr-org/mlr3extralearners")

#

# if this fails (e.g. if you are using renv to manage packages then it might), you may need to use

# remotes::install_github("mlr-org/mlr3extralearners", INSTALL_opts = c("--no-multiarch") )

# see https://github.com/rstudio/renv/issues/162

Package checking complete

Now that we’ve checked the required packages are there, we can get started with the example by attaching the libraries we require.

# machine learning libraries

library(mlr3) # base mlr3 package

library(mlr3learners) # implements common learners

library(mlr3tuning) # tuning methodology

library(paradox) # used to create parameter sets for hyperparameter tuning

library(mlr3extralearners) # needed for glms

# data manipulation

library(data.table)

# graphing

library(ggplot2) # plotting

library(patchwork) # easy way to combine ggplots

library(rpart.plot) # to draw decision trees created by rpart

# making nice tables

library(kableExtra)

library(IRdisplay) # displays tables when in ipynb format

# stop R from showing big numbers in scientific notation

options("scipen"=99)

# colours for plots - not all are used

# We will also use viridis for some plots

dblue <- "#113458"

mblue <- "#4096b8"

gold <- "#d9ab16"

lgrey <- "#dcddd9"

dgrey <- "#3f4548"

black <- "#3F4548"

red <- "#d01e45"

purple <- "#8f4693"

orange <- "#ee741d"

fuscia <- "#e9458c"

violet <- "#8076cf"

Loading required package: paradox

Attaching package: ‘mlr3extralearners’

The following objects are masked from ‘package:mlr3’:

lrn, lrns

Loading required package: rpart

Data preparation#

We’re using a simulated data triangle with all values (past and future).

The data set we use is the simulated data set 3 from this paper. It is available in CSV form here.

This is a 40x40 triangle of payments:

That vary by accident quarter

That vary by development quarter

Have varying rates of superimposed inflation in payment size by calendar quarter (including no inflation)

Have a step-up in payment size for accident quarters > 16 and development quarters > 20.

The first two effects are captured by a Chainladder model but the last two effects depart from Chainladder assumptions.

data.table package#

We’ll be using the data.table package for manipulating the data. There’s an introduction to data.table on our blog if you are unfamiliar with it.

If you see := in the R code, then that’s data.table assignment.

(Actually in the code chunks you may see an underscore under the := - this is inserted by the formatting we are using to prepare the notebook for some reason, so please ignore the underscore).

Load the data#

First, load in the data and have a look at it.

dat <- fread("https://institute-and-faculty-of-actuaries.github.io/mlr-blog/csv/lasso_simdata3.csv")

head(dat)

tail(dat)

# create the num_periods variable - number of acc/dev periods

num_periods <- dat[, max(acc)]

| pmts | acc | dev | cal | mu | train_ind |

|---|---|---|---|---|---|

| <dbl> | <int> | <int> | <int> | <dbl> | <lgl> |

| 242671.2 | 1 | 1 | 1 | 71653.13 | TRUE |

| 164001.3 | 1 | 2 | 2 | 1042775.62 | TRUE |

| 3224477.8 | 1 | 3 | 3 | 4362599.77 | TRUE |

| 3682530.8 | 1 | 4 | 4 | 10955670.09 | TRUE |

| 10149368.6 | 1 | 5 | 5 | 20800545.12 | TRUE |

| 28578274.7 | 1 | 6 | 6 | 33089166.75 | TRUE |

| pmts | acc | dev | cal | mu | train_ind |

|---|---|---|---|---|---|

| <dbl> | <int> | <int> | <int> | <dbl> | <lgl> |

| 125261750 | 40 | 35 | 74 | 109039367 | FALSE |

| 62657370 | 40 | 36 | 75 | 82853302 | FALSE |

| 63467681 | 40 | 37 | 76 | 62682720 | FALSE |

| 26041979 | 40 | 38 | 77 | 47227843 | FALSE |

| 33947274 | 40 | 39 | 78 | 35444881 | FALSE |

| 37258687 | 40 | 40 | 79 | 26503298 | FALSE |

As you can see, the data is not in triangular form as per the diagram above, but is instead in long form where:

each row of the data set consists of one observation

each observation has the accident(

acc), development(dev) and calendar(cal) period associated with itthe

muvalue is the mean value of the distribution from whichpmtswas simulated - this won’t form part of the analysis below so can be ignoredthe final variable,

train_indisTRUEfor past values andFALSEfor future values.

This long format of data is standard for a lot of modelling and data analysis.

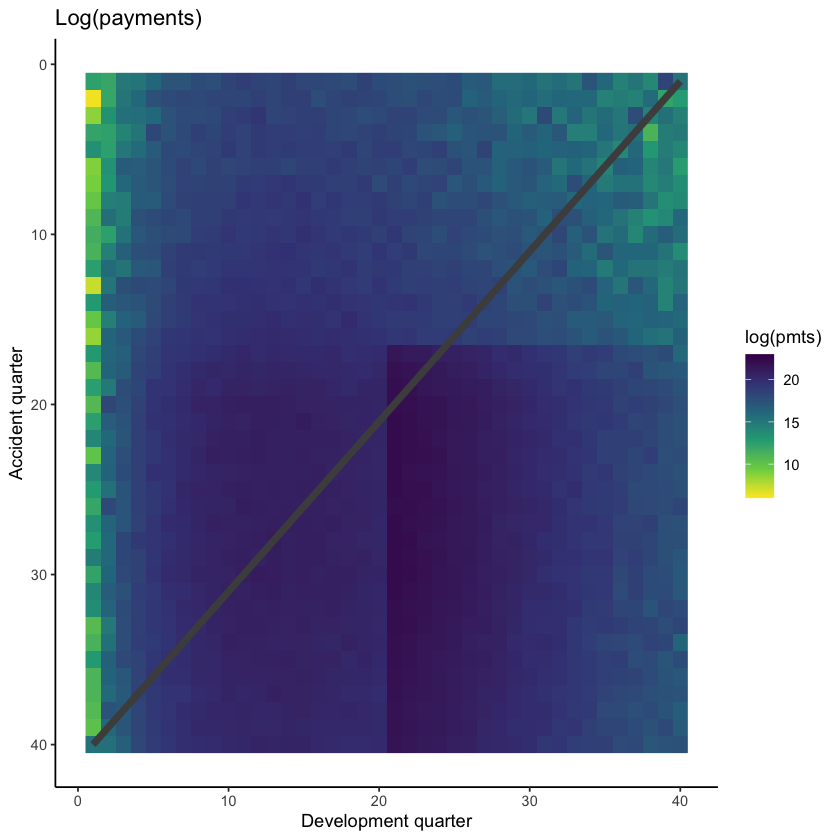

We can also show a visualisation of the data. This contains both past and future data (with a diagonal line marking the boundary). The plot uses shading to indicate the size of the payments (specifically, log(payments)). The step-up in claim size (acc > 16 and dev > 20) is quite obvious in this graphic. What is also apparent is this this increase only affects a small part of the past triangle (10 cells out of 820 to be exact), but impacts much of the future lower triangle.

# get limits for use with raster plots

data_raster_limits <- c(floor(dat[, min(log(pmts))]), ceiling(dat[, max(log(pmts))]))

ggplot(dat, aes(dev, acc)) +

geom_raster(aes(fill = log(pmts)))+

geom_line(aes(x=num_periods+1-acc, y=acc), colour="grey30", size=2)+

scale_y_reverse()+

scale_fill_viridis_c(begin=1, end=0, limits=data_raster_limits)+

theme_classic()+

labs(x="Development quarter", y="Accident quarter", title="Log(payments)")+

NULL

The step-up in payments can be modelled as an interaction between accident and development quarters. Because it affects only a small number of past values, it may be difficult for some of the modelling approaches to capture this. It’s likely, therefore, that the main differentiator between the performance of different methods for this data set will be how much well they capture this interaction.

One thing to note is that the Chainladder will struggle with this data set. Both the calendar period terms and the interaction are not effects that the Chainladder can model - it assumes that only accident and development period main effects (i.e. no interactions) are present. So an actuary using the Chainladder for this data set would need to overlay judgement to obtain a good result.

We need to modify this data a little before proceeding further:

We’ll add factor versions (essentially a categorical version) of acc and dev - these are needed later for fitting the Chainladder

We’ll add a unique ID associated with each row

# data.table code, := is assignment

# if you see an underscore under the := in the code below, then this is a formatting thing - ignore the underscore here and elsewhere

# the code should look like this: dat[, accf := as.factor(acc)]

dat[, accf := as.factor(acc)]

dat[, devf := as.factor(dev)]

# data.table code, .N = number of rows

dat[, row_id := 1:.N]

tail(dat)

| pmts | acc | dev | cal | mu | train_ind | accf | devf | row_id |

|---|---|---|---|---|---|---|---|---|

| <dbl> | <int> | <int> | <int> | <dbl> | <lgl> | <fct> | <fct> | <int> |

| 125261750 | 40 | 35 | 74 | 109039367 | FALSE | 40 | 35 | 1595 |

| 62657370 | 40 | 36 | 75 | 82853302 | FALSE | 40 | 36 | 1596 |

| 63467681 | 40 | 37 | 76 | 62682720 | FALSE | 40 | 37 | 1597 |

| 26041979 | 40 | 38 | 77 | 47227843 | FALSE | 40 | 38 | 1598 |

| 33947274 | 40 | 39 | 78 | 35444881 | FALSE | 40 | 39 | 1599 |

| 37258687 | 40 | 40 | 79 | 26503298 | FALSE | 40 | 40 | 1600 |

Create a mlr3 task#

Now create an mlr3 task - making an object to hold data and set roles for the data. These tasks abstract away (i.e. do it for you) all the hard work in getting the data into the right form for each model (learner in mlr3 parlance) - just specify what the target is and what the features are, and mlr3 will take care of the rest.

We need to make a regression task since we will be estimating payments. So we make a new instance of the TaskRegr class via TaskRegr$new.

When loading the data in via the backend, we’ve omitted mu since this is not used in the modelling.

We’ve also omitted the factor versions of acc and dev.

# note can also use the sugar function tsk()

task <- TaskRegr$new(id = "reserves",

backend = dat[, .(pmts, train_ind, acc, dev, cal, row_id)],

target = "pmts")

# look at the task

task

<TaskRegr:reserves> (1600 x 6)

* Target: pmts

* Properties: -

* Features (5):

- int (4): acc, cal, dev, row_id

- lgl (1): train_ind

We need to ensure everything is correctly assigned:

Future data must not be used for model training. Currently all parts of the triangle are used because we loaded all the data into the

backend.The right features must be used in model training. Right now

row_idandtrain_indare also included in the features which is incorrect.

For the first, we’ll use row_roles to ensure that future data is not used for model training.

There are two types of row_roles - use and validation. Right now all rows are in use.

# number of entries in use

print(length(task$row_roles$use))

# for brevity just print first 10 elements

print(task$row_roles$use[1:10])

# number of entries in validation

print(length(task$row_roles$validation))

[1] 1600

[1] 1 2 3 4 5 6 7 8 9 10

[1] 0

Move all future values (train_ind==FALSE) into validation so they are not used in the model.

We can’t edit row_roles directly, so use the method (set_row_roles()) to do this. Supply the list of future row_ids in the first argument.

task$set_row_roles(dat[train_ind==FALSE, row_id], roles="validation")

Check that the task has been updated correctly.

# number of entries in use

print(length(task$row_roles$use))

# for brevity just print the end of the second accident period - row id 80 should be in validate

print(task$row_roles$use[70:90])

# number of entries in validation

print(length(task$row_roles$validation))

print(task$row_roles$validation[1:10])

[1] 820

[1] 70 71 72 73 74 75 76 77 78 79 81 82 83 84 85 86 87 88 89 90 91

[1] 780

[1] 80 119 120 158 159 160 197 198 199 200

This looks right (we’ve checked more than this, but have limited what we display in this notebook).

Now we need to remove row_id and train_ind from the list of features:

we’ll ignore

train_ind(so it won’t have any role)we’ll set

row_idto be a name. This could be used in plots to label points if needed.

# make row_id a name

task$set_col_roles("row_id", roles="name")

# drop train_ind from the feature list

task$col_roles$feature <- setdiff(task$feature_names, "train_ind")

# check the task has the correct variables now

task

# check alll the col_roles

print(task$col_roles)

<TaskRegr:reserves> (820 x 4)

* Target: pmts

* Properties: -

* Features (3):

- int (3): acc, cal, dev

$feature

[1] "acc" "cal" "dev"

$target

[1] "pmts"

$name

[1] "row_id"

$order

character(0)

$stratum

character(0)

$group

character(0)

$weight

character(0)

$uri

character(0)

Tuning process for hyper-parameters#

Machine learning models have a number of hyper-parameters that control the model fit. Tweaking the hyper-parameters that control model fitting (e.g. for decision trees, the depth of the tree, or for random forests, the number of trees to average over) can have a significant impact on the quality of the fit. The standard way of doing this is to use a train and test data set where:

The model is trained (built) on the train data set

The performance of the model is evaluated on the test data set

This is repeated for a number of different combinations of hyper-parameters, and the best performing one is selected.

Evaluating the models on a separate data set not used in the model fitting helps to control over-fitting. Usually we would then select the hyper-parameters that lead to the best results on the test data set and use these to predict our future values.

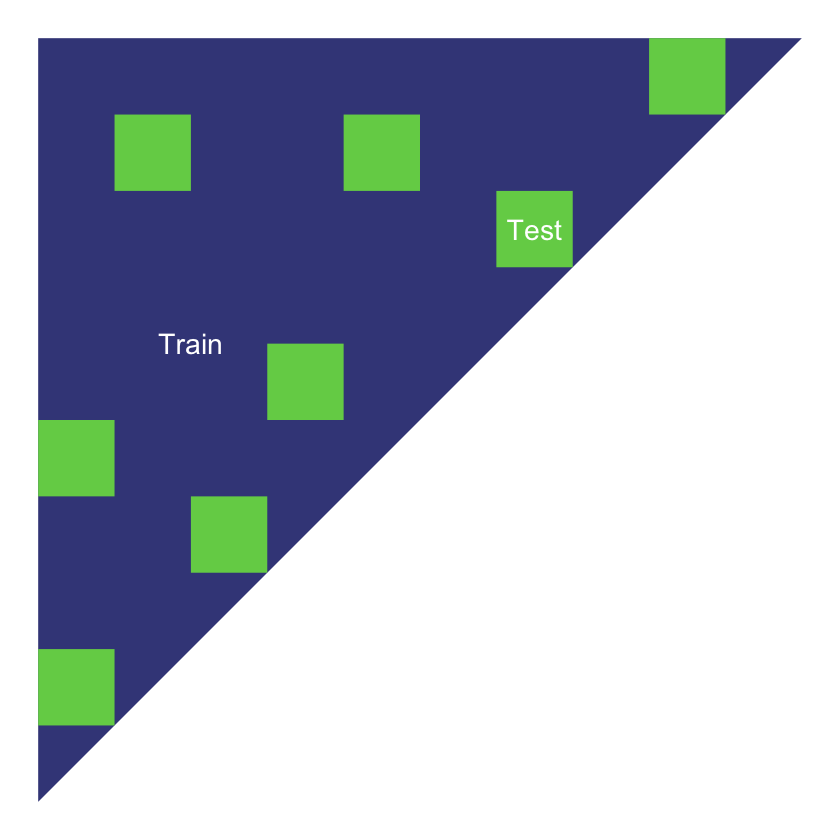

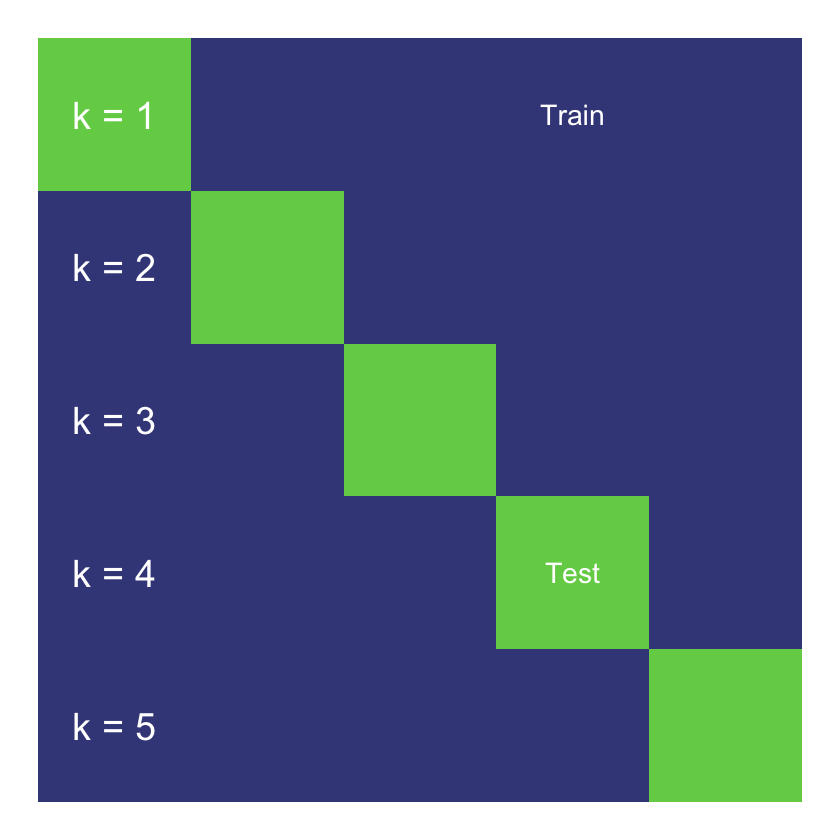

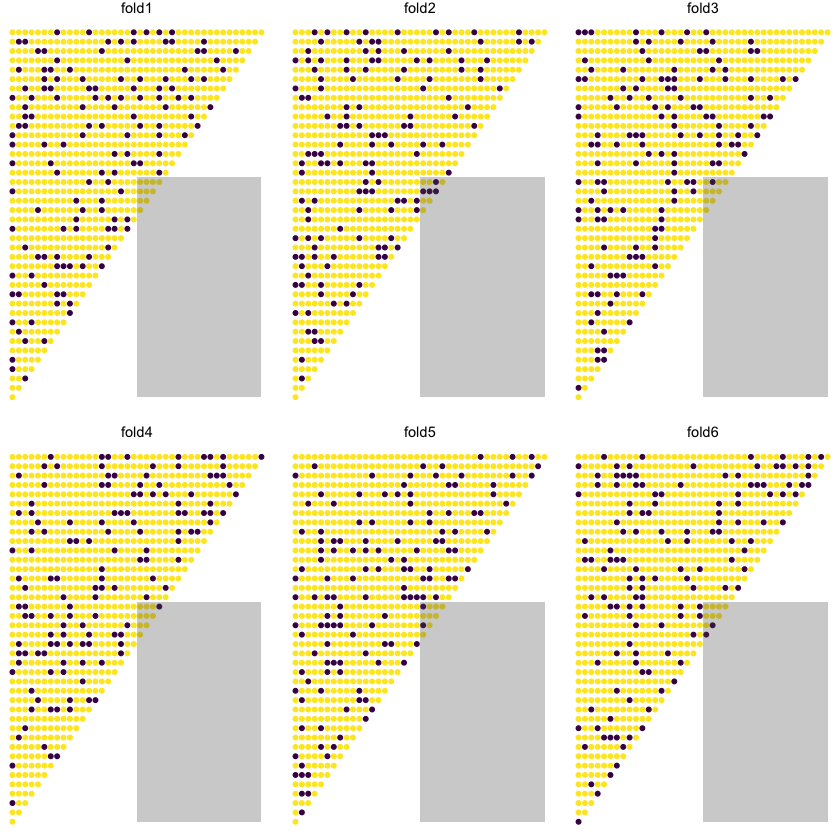

There are various ways we can select the test and train data sets. For this work we use cross-validation. We’ll give a brief overview of it below. Note that we will be discussing validation options in a separate article.

Cross-validation#

The simplest implementation of a train and test partition is a random one where each point in the data set is allocated to train and test at random. Typically, the train part might be around 70-80% of the data and the test part the remainder.

Random test data set

Cross-validation repeats this type of split a number of times.

In more detail, the steps are:

Randomly partition the data into k equal-sized folds (between 5-10 folds are common choices). These folds are then fixed for the remainder of the algorithm.

This means that we do a train/test split like the triangle above but repeat this k times.

Fit the model using data from k-1 of the folds, using the remaining fold as the test data. Do this k times, so each fold is used as test data once.

Calculate the performance metrics for each model on the corresponding test fold.

Average the performance metrics across all the folds.

A simplified representation of the process is given below.

5-fold cross validation

Cross-validation provides an estimate of out-of-sample performance even though all the data is used for training and testing. It is often considered more robust due to its use of the full dataset for testing, but can be computationally expensive for larger datasets. Here we only have a small amount of data, so there is an advantage to using the full dataset, whilst the computational cost is manageable.

Setting up cross-validation in mlr3#

We can set up a cross-validation resampler in mlr3 that can then be applied to any model. As always, the book is a useful starting reference point.

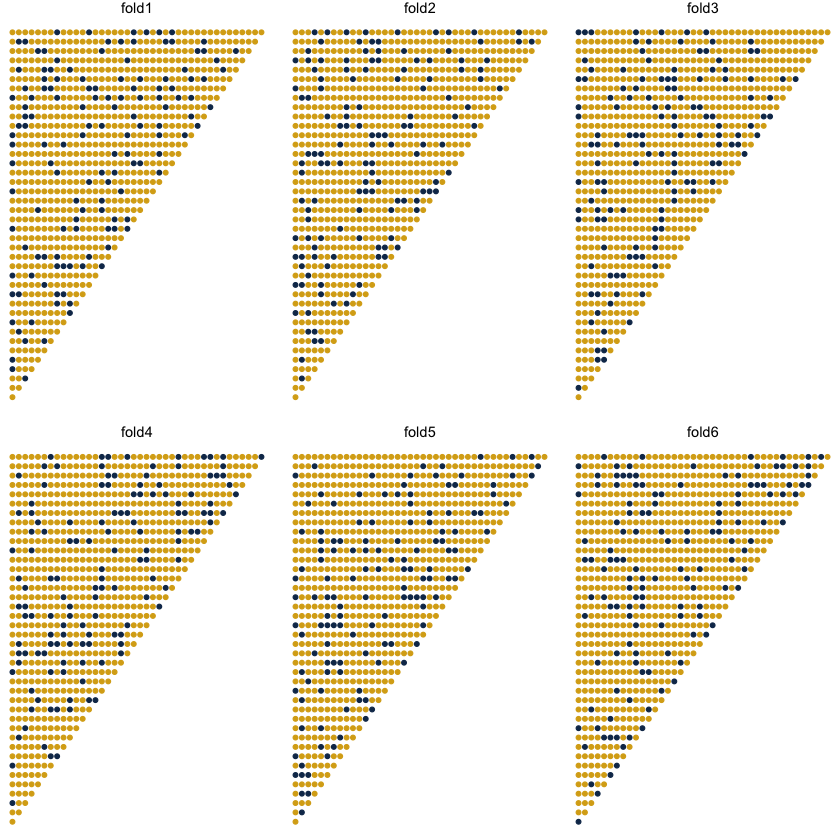

Here we will use 6-fold cross validation.

# create object

crossval = rsmp("cv", folds=6)

set.seed(42) # reproducible results

# populate the folds

# NB: mlr3 will only use data where role was set to “use”

crossval$instantiate(task)

Below we show the allocation of points into test and train for each fold - the dark blue points are the test subset in each of the 6 folds.

Performance measure#

As well as the cross-validation process, we want to set up a performance measure to use. Here we will use RMSE (root mean square error).

# to see all measures use

# mlr_measures$help()

# follow the links for a specific one, or you can type

# ?mlr_measures_regr.rmse to get help for RMSE, and then insert the

# other names for others, eg ?mlr_measures_regr.rmsle etc

measure <- msr("regr.rmse")

Searching hyper-parameter space#

Searching hyper-parameter space needs to be customised to each model, so we can’t set up a common framework here. However, to control computations, it is useful to set a limit on the number of searches that can be performed in a tuning exercise. mlr3 offers a number of different options for terminating searches - here we are just going to use the simplest one - where only a limited number of evaluations are permitted.

Given how we set up the tuning process below we need 25 evaluations for the decision tree and random forest models. We need many more evaluations for the XGBoost model since we tune more parameters. However, this can take a long time to run. In practice, using a more powerful computer, or running things in parallel can help.

So we’ve set the number of evaluations to a low number here (25). For the XGBoost model, we used 500 evaluations to tune the hyper-parameters and saved the results for use here.

# setting we used to get the xgboost results below

#evals_trm = trm("evals", n_evals = 500)

# using a low number so things run quickly

evals_trm = trm("evals", n_evals = 25)

Fitting some ML models#

Now it’s time to fit and tune the following ML models using mlr3:

Decision tree

Random forest

XGBoost

Decision tree#

A decision tree is unlikely to be a very good model for this data, and tuning often doesn’t help much. Nonetheless, it’s a simple model, so it’s useful to fit it to see what happens.

To illustrate the use of mlr3, we’ll first show how to fit a model using the default hyper-parameters. We’ll then move onto the code needed to run hyper-parameter tuning using cross-validation.

Fitting a single model#

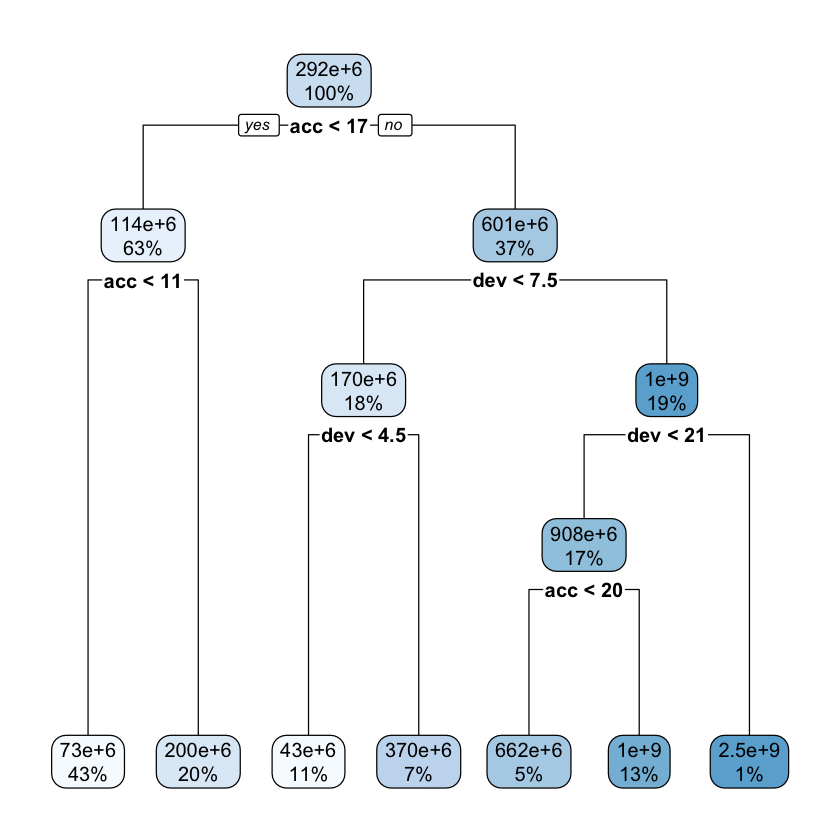

First let’s fit a decision tree using default parameters.

# create a learner, ie a container for a decision tree model

lrn_rpart_default <- lrn("regr.rpart")

# fit the model on all the past data (ie where row_roles==use)

lrn_rpart_default$train(task)

# Visualise the tree

rpart.plot::rpart.plot(lrn_rpart_default$model, roundint = FALSE)

If you are unfamiliar with decision tree diagrams, the model specifies that, for example, for accident years greater than 17, with development periods less than 7.5 (ie 7 or under) and less than 4.5, the predicted claim cost is $43m.

While the tree is fairly simple, we do see splits for acc<17 and dev<21, which match the location of the interaction.

Here’s a list of the parameters - the documentation on rpart.control will have more information.

lrn_rpart_default$param_set

<ParamSet>

id class lower upper nlevels default value

1: minsplit ParamInt 1 Inf Inf 20

2: minbucket ParamInt 1 Inf Inf <NoDefault[3]>

3: cp ParamDbl 0 1 Inf 0.01

4: maxcompete ParamInt 0 Inf Inf 4

5: maxsurrogate ParamInt 0 Inf Inf 5

6: maxdepth ParamInt 1 30 30 30

7: usesurrogate ParamInt 0 2 3 2

8: surrogatestyle ParamInt 0 1 2 0

9: xval ParamInt 0 Inf Inf 10 0

10: keep_model ParamLgl NA NA 2 FALSE

Let’s try tuning the cp and minsplit parameters.

Tuning the decision tree#

To set up the tuning we need to specify:

The ranges of values to search over

A resampling strategy (already have this - crossvalidation)

An evaluation measure (this is RMSE)

A termination criterion so searches don’t go on for ever (our

evals_trm)The search strategy (e.g. grid search, random search, etc - see, e.g., this post )

We first set ranges of values to consider for these using functionality from the paradox library.

tune_ps_rpart <- ps(

cp = p_dbl(lower = 0.001, upper = 0.1),

minsplit = p_int(lower = 1, upper = 10)

)

We can see what’s going to be searched over if we specify a 5x5 grid

# to see what's searched if we set a grid of 5

rbindlist(generate_design_grid(tune_ps_rpart, 5)$transpose())

| cp | minsplit |

|---|---|

| <dbl> | <int> |

| 0.00100 | 1 |

| 0.00100 | 3 |

| 0.00100 | 5 |

| 0.00100 | 8 |

| 0.00100 | 10 |

| 0.02575 | 1 |

| 0.02575 | 3 |

| 0.02575 | 5 |

| 0.02575 | 8 |

| 0.02575 | 10 |

| 0.05050 | 1 |

| 0.05050 | 3 |

| 0.05050 | 5 |

| 0.05050 | 8 |

| 0.05050 | 10 |

| 0.07525 | 1 |

| 0.07525 | 3 |

| 0.07525 | 5 |

| 0.07525 | 8 |

| 0.07525 | 10 |

| 0.10000 | 1 |

| 0.10000 | 3 |

| 0.10000 | 5 |

| 0.10000 | 8 |

| 0.10000 | 10 |

Given we only have 25 points (in a grid of 5), we can easily evaluate every option so we’ll use a grid search strategy. In practice other search strategies may be preferable - e.g. a random search often gets similar results to a grid search, in a much smaller amount of time. Another possible choice is Bayesian optimisation search.

So now we have everything we need to tune our hyper-parameters so we can set this up in mlr3 now.

# create the hyper-parameter for this particular learner/model

instance_rpart <- TuningInstanceSingleCrit$new(

task = task,

learner = lrn("regr.rpart"),

resampling = crossval,

measure = measure,

search_space = tune_ps_rpart,

terminator = evals_trm

)

# create a grid-search tuner for a 5-point grid

tuner <- tnr("grid_search", resolution = 5)

Finally, we run the tuning on the instance_rpart space.

# suppress log output for readability

lgr::get_logger("bbotk")$set_threshold("warn")

lgr::get_logger("mlr3")$set_threshold("warn")

tuner$optimize(instance_rpart)

# restart log output

lgr::get_logger("bbotk")$set_threshold("info")

lgr::get_logger("mlr3")$set_threshold("info")

The parameters in the best fit may be accessed here:

print(instance_rpart$result_learner_param_vals)

$xval

[1] 0

$cp

[1] 0.001

$minsplit

[1] 3

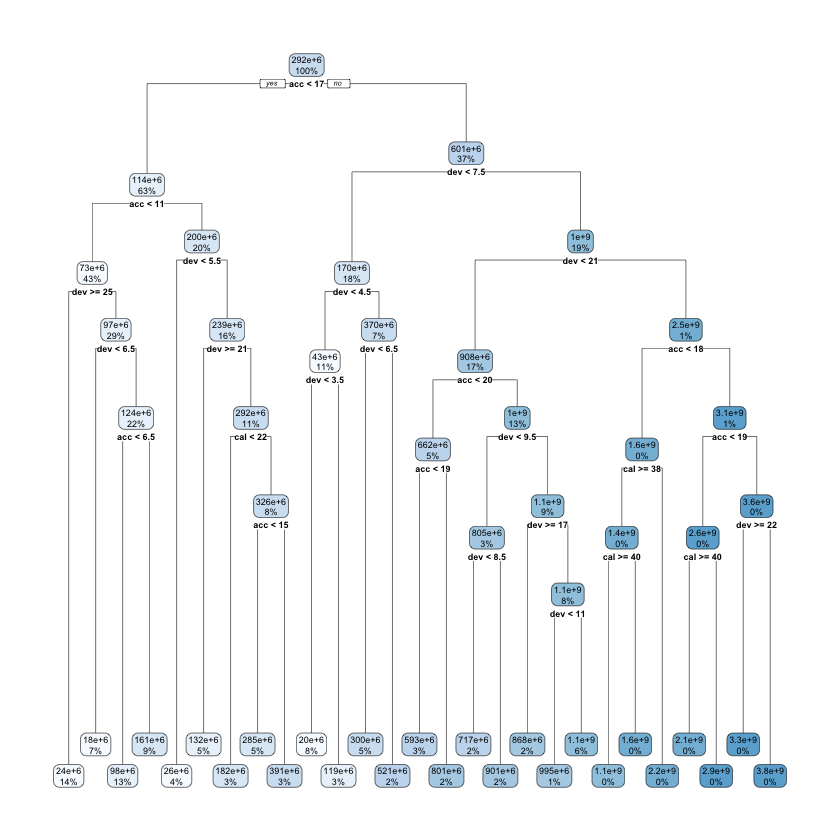

So we can now fit a final model to all the data using these optimised parameters.

lrn_rpart_tuned <- lrn("regr.rpart")

lrn_rpart_tuned$param_set$values = instance_rpart$result_learner_param_vals

lrn_rpart_tuned$train(task)

# plot the model

rpart.plot::rpart.plot(lrn_rpart_tuned$model, roundint = FALSE)

This model is much more complicated than the original and looks overfitted - we’ll see if this is the case when we evaluate the model performance later in the article.

Random forest fitting#

The ranger random forest package is implemented in mlr3learners (the regression version is regr.ranger).

Let’s have a look at the hyper-parameters.

lrn("regr.ranger")$param_set

<ParamSet>

id class lower upper nlevels default

1: alpha ParamDbl -Inf Inf Inf 0.5

2: always.split.variables ParamUty NA NA Inf <NoDefault[3]>

3: holdout ParamLgl NA NA 2 FALSE

4: importance ParamFct NA NA 4 <NoDefault[3]>

5: keep.inbag ParamLgl NA NA 2 FALSE

6: max.depth ParamInt -Inf Inf Inf

7: min.node.size ParamInt 1 Inf Inf 5

8: min.prop ParamDbl -Inf Inf Inf 0.1

9: minprop ParamDbl -Inf Inf Inf 0.1

10: mtry ParamInt 1 Inf Inf <NoDefault[3]>

11: num.random.splits ParamInt 1 Inf Inf 1

12: num.threads ParamInt 1 Inf Inf 1

13: num.trees ParamInt 1 Inf Inf 500

14: oob.error ParamLgl NA NA 2 TRUE

15: quantreg ParamLgl NA NA 2 FALSE

16: regularization.factor ParamUty NA NA Inf 1

17: regularization.usedepth ParamLgl NA NA 2 FALSE

18: replace ParamLgl NA NA 2 TRUE

19: respect.unordered.factors ParamFct NA NA 3 ignore

20: sample.fraction ParamDbl 0 1 Inf <NoDefault[3]>

21: save.memory ParamLgl NA NA 2 FALSE

22: scale.permutation.importance ParamLgl NA NA 2 FALSE

23: se.method ParamFct NA NA 2 infjack

24: seed ParamInt -Inf Inf Inf

25: split.select.weights ParamDbl 0 1 Inf <NoDefault[3]>

26: splitrule ParamFct NA NA 3 variance

27: verbose ParamLgl NA NA 2 TRUE

28: write.forest ParamLgl NA NA 2 TRUE

id class lower upper nlevels default

parents value

1: splitrule

2:

3:

4:

5:

6:

7:

8:

9: splitrule

10:

11: splitrule

12: 1

13:

14:

15:

16:

17:

18:

19:

20:

21:

22: importance

23:

24:

25:

26:

27:

28:

parents value

Here, we’ll try tuning number of trees (num.trees) and the minimum node size (min.node.size). max.depth, mtry and sample.fraction are also often helpful to tune.

We’ll follow the same steps as for decision trees - set up a parameter space for searching, combine this with RMSE and cross-validation and then tune using grid search.

tune_ps_ranger <- ps(

num.trees = p_int(lower = 100, upper = 900),

min.node.size = p_int(lower = 1, upper = 5)

)

# to see what's searched if we set a grid of 5

#rbindlist(generate_design_grid(tune_ps_ranger, 5)$transpose())

instance_ranger <- TuningInstanceSingleCrit$new(

task = task,

learner = lrn("regr.ranger"),

resampling = crossval,

measure = measure,

search_space = tune_ps_ranger,

terminator = evals_trm

)

# suppress output

lgr::get_logger("bbotk")$set_threshold("warn")

lgr::get_logger("mlr3")$set_threshold("warn")

#We can reuse the tuner we set up for the decision tree

#this was tuner <- tnr("grid_search", resolution = 5)

tuner$optimize(instance_ranger)

# turn output back on

lgr::get_logger("bbotk")$set_threshold("info")

lgr::get_logger("mlr3")$set_threshold("info")

Get the best fit

print(instance_ranger$result_learner_param_vals)

$num.threads

[1] 1

$num.trees

[1] 500

$min.node.size

[1] 3

Now we fit the model to all the parameters

lrn_ranger_tuned <- lrn("regr.ranger")

lrn_ranger_tuned$param_set$values = instance_ranger$result_learner_param_vals

lrn_ranger_tuned$train(task)

lrn_ranger_tuned$model

Ranger result

Call:

ranger::ranger(dependent.variable.name = task$target_names, data = task$data(), case.weights = task$weights$weight, num.threads = 1L, num.trees = 500L, min.node.size = 3L)

Type: Regression

Number of trees: 500

Sample size: 820

Number of independent variables: 3

Mtry: 1

Target node size: 3

Variable importance mode: none

Splitrule: variance

OOB prediction error (MSE): 14273383385093214

R squared (OOB): 0.9223578

XGBoost#

Here are the XGBoost parameters.

# Can just run

# lrn("regr.xgboost")$param_set

# the code below just removes some of the columns for display purposes

kable_styling(

kable(as.data.table(lrn("regr.xgboost")$param_set)[, .(id, class, default)]),

full_width = FALSE) %>%

as.character() %>%

display_html()

| id | class | default |

|---|---|---|

| booster | ParamFct | gbtree |

| watchlist | ParamUty | NULL |

| eta | ParamDbl | 0.3 |

| gamma | ParamDbl | 0 |

| max_depth | ParamInt | 6 |

| min_child_weight | ParamDbl | 1 |

| subsample | ParamDbl | 1 |

| colsample_bytree | ParamDbl | 1 |

| colsample_bylevel | ParamDbl | 1 |

| colsample_bynode | ParamDbl | 1 |

| num_parallel_tree | ParamInt | 1 |

| lambda | ParamDbl | 1 |

| lambda_bias | ParamDbl | 0 |

| alpha | ParamDbl | 0 |

| objective | ParamUty | reg:linear |

| eval_metric | ParamUty | rmse |

| base_score | ParamDbl | 0.5 |

| max_delta_step | ParamDbl | 0 |

| missing | ParamDbl | NA |

| monotone_constraints | ParamInt | 0 |

| tweedie_variance_power | ParamDbl | 1.5 |

| nthread | ParamInt | 1 |

| nrounds | ParamInt | <environment: 0x7fe606ea60a8> |

| feval | ParamUty | NULL |

| verbose | ParamInt | 1 |

| print_every_n | ParamInt | 1 |

| early_stopping_rounds | ParamInt | NULL |

| maximize | ParamLgl | NULL |

| sample_type | ParamFct | uniform |

| normalize_type | ParamFct | tree |

| rate_drop | ParamDbl | 0 |

| skip_drop | ParamDbl | 0 |

| one_drop | ParamLgl | FALSE |

| tree_method | ParamFct | auto |

| grow_policy | ParamFct | depthwise |

| max_leaves | ParamInt | 0 |

| max_bin | ParamInt | 256 |

| callbacks | ParamUty | NULL |

| sketch_eps | ParamDbl | 0.03 |

| scale_pos_weight | ParamDbl | 1 |

| updater | ParamUty | <environment: 0x7fe5f4390ef0> |

| refresh_leaf | ParamLgl | TRUE |

| feature_selector | ParamFct | cyclic |

| top_k | ParamInt | 0 |

| predictor | ParamFct | cpu_predictor |

| save_period | ParamInt | NULL |

| save_name | ParamUty | NULL |

| xgb_model | ParamUty | NULL |

| interaction_constraints | ParamUty | <environment: 0x7fe5fa9f8728> |

| outputmargin | ParamLgl | FALSE |

| ntreelimit | ParamInt | NULL |

| predleaf | ParamLgl | FALSE |

| predcontrib | ParamLgl | FALSE |

| approxcontrib | ParamLgl | FALSE |

| predinteraction | ParamLgl | FALSE |

| reshape | ParamLgl | FALSE |

| training | ParamLgl | FALSE |

With gradient boosting, it is often helpful to optimise over hyper-parameters, so we will vary some parameters and select the best performing set.

For speed reasons we will just consider tweedie_variance_power, eta, max_depth , and nrounds but in practice, we could consider doing more.

The steps are the generally same as before for decision trees and random forests.

However as we are searching over a greater number of parameters, we’ve switched to a random search to try to achieve better results.

Depending on your computer, this step takes a while to run (since our terminator is 500 evaluations) - so it might be a good point to grab a cup of coffee or tea! Alternatively reduce the number of evaluations in eval_trm.

tune_ps_xgboost <- ps(

# ensure non-negative values

objective = p_fct("reg:tweedie"),

tweedie_variance_power = p_dbl(lower = 1.01, upper = 1.99),

# eta can be up to 1, but usually it is better to use low eta, and tune nrounds for a more fine-grained model

eta = p_dbl(lower = 0.01, upper = 0.3),

# select value for gamma

# tuning can help overfitting but we don't investigate this here

gamma = p_dbl(lower = 0, upper = 0),

# We know that the problem is not that deep in interactivity so we search a low depth

max_depth = p_int(lower = 2, upper = 6),

# nrounds to stop overfitting

nrounds = p_int(lower = 100, upper = 500)

)

instance_xgboost <- TuningInstanceSingleCrit$new(

task = task,

learner = lrn("regr.xgboost"),

resampling = crossval,

measure = measure,

search_space = tune_ps_xgboost,

terminator = evals_trm

)

# need to make a new tuner with resolution 4

#tuner <- tnr("grid_search", resolution = 4)

set.seed(84) # for random search for reproducibility

tuner <- tnr("random_search")

lgr::get_logger("bbotk")$set_threshold("warn")

lgr::get_logger("mlr3")$set_threshold("warn")

time_bef <- Sys.time()

tuner$optimize(instance_xgboost)

lgr::get_logger("bbotk")$set_threshold("info")

lgr::get_logger("mlr3")$set_threshold("info")

Sys.time() - time_bef

| objective | tweedie_variance_power | eta | gamma | max_depth | nrounds | learner_param_vals | x_domain | regr.rmse |

|---|---|---|---|---|---|---|---|---|

| <chr> | <dbl> | <dbl> | <dbl> | <int> | <int> | <list> | <list> | <dbl> |

| reg:tweedie | 1.555728 | 0.1107844 | 0 | 4 | 467 | 467 , 1 , 0 , reg:tweedie , 1.55572789821774 , 0.110784432103392, 0 , 4 | reg:tweedie , 1.55572789821774 , 0.110784432103392, 0 , 4 , 467 | 80517695 |

Time difference of 34.90743 secs

Get the best fit:

print(instance_xgboost$result_learner_param_vals)

$nrounds

[1] 467

$nthread

[1] 1

$verbose

[1] 0

$objective

[1] "reg:tweedie"

$tweedie_variance_power

[1] 1.555728

$eta

[1] 0.1107844

$gamma

[1] 0

$max_depth

[1] 4

However, remember that these results are from 25 evaluations only, and with 4 hyper-parameters, we’d really like to use more evaluations. The model above isn’t a particularly good one

The table below shows the results we got from 500 evaluations along with the results we got in earlier development work for this article (the hyper-parameter tuning results are subject to randomness, first due to the specification of the cross-validation folds and second due to the random search). We’ll use these when looking at the model.

| Hyperparameter | Evals500 | Best |

|---|---|---|

| nrounds | 265 | 233 |

| tweedie_variance_power | 1.011768 | 1.01 |

| eta | 0.2310797 | 0.3 |

| gamma[fixed] | 0 | 0 |

| max_depth | 3 | 3 |

We’ll fit both models here:

lrn_xgboost_tuned- the results found from running the tuning code with 500 evaluationslrn_xgboost_prevtuned- the best results we found in previous work

lrn_xgboost_prevtuned = lrn("regr.xgboost", objective="reg:tweedie", nrounds=233,

tweedie_variance_power=1.01, eta=0.3, gamma=0, max_depth=3)

lrn_xgboost_prevtuned$train(task)

lrn_xgboost_tuned = lrn("regr.xgboost", objective="reg:tweedie", nrounds=265,

tweedie_variance_power=1.011768, eta=0.2310797, gamma=0, max_depth=3)

lrn_xgboost_tuned$train(task)

If, instead, you would like to fit the XGBoost model found after 25 evaluations, you can use the code below to pick up the selected values after tuning. This replaces the model fitted above using the hyper-parameters found after 500 evaluations.

lrn_xgboost_tuned = lrn("regr.xgboost")

lrn_xgboost_tuned$param_set$values = instance_xgboost$result_learner_param_vals

lrn_xgboost_tuned$train(task)

We haven’t run this code so our lrn_xgboost_tuned uses the 500 evaluations results.

Consolidate results#

Now we will consolidate results for these models. We will gather together:

RMSE for past and future data

predictions for each model.

Note that mlr3 has various benchmarking tools which we haven’t used here - partially because we want to focus on the concepts rather than the code and partially because we want to compare the results to a couple of other models not fitted in the same framework. If you’re interested in learning more then the section on benchmarking in the mlr3 book is a good start. Pipelines offer more flexible functionality too.

First, we’ll set up a data.table to hold the model projections for each model and populate these projections for each model

# make a new copy of the data, deleting the row_id, accf and devf columns

model_forecasts <- copy(dat)[, c("row_id", "accf", "devf") := NULL]

# add the model projections - specify list of learners to use and their names

lrnrs <- c(lrn_rpart_tuned, lrn_ranger_tuned, lrn_xgboost_tuned, lrn_xgboost_prevtuned)

# the id property is used to name the variables - since we have 2 xgboosts, adjust id where necessary

lrn_xgboost_prevtuned$id <- "regr.xgboost_prev"

for(l in lrnrs){

#learner$predict(task, row_ids) is how to get predicted values, returns 3 cols with preds in response

# use row_ids to tell it to use entire data set, ie "use" and validation rows

#model_forecasts[, (nl) := l$predict(task, row_ids=1:nrow(dat))$response]

model_forecasts[, l$id := l$predict(task=task, row_ids=1:nrow(dat))$response]

}

tail(model_forecasts)

| pmts | acc | dev | cal | mu | train_ind | regr.rpart | regr.ranger | regr.xgboost | regr.xgboost_prev |

|---|---|---|---|---|---|---|---|---|---|

| <dbl> | <int> | <int> | <int> | <dbl> | <lgl> | <dbl> | <dbl> | <dbl> | <dbl> |

| 125261750 | 40 | 35 | 74 | 109039367 | FALSE | 3276251556 | 1039427724 | 2161421312 | 180676800 |

| 62657370 | 40 | 36 | 75 | 82853302 | FALSE | 3276251556 | 1039394694 | 1662855296 | 97294160 |

| 63467681 | 40 | 37 | 76 | 62682720 | FALSE | 3276251556 | 1039474983 | 2963930368 | 228004720 |

| 26041979 | 40 | 38 | 77 | 47227843 | FALSE | 3276251556 | 1039475232 | 1337462528 | 201791488 |

| 33947274 | 40 | 39 | 78 | 35444881 | FALSE | 3276251556 | 1039563647 | 458035488 | 97800608 |

| 37258687 | 40 | 40 | 79 | 26503298 | FALSE | 3276251556 | 1039497978 | 458035488 | 97800608 |

Before we do any analysis, let’s fit a couple more models to compare these results against:

a Chainladder model

a LASSO model

Chainladder - the baseline model#

Since this is a traditional triangle, it seems natural to compare any results to the Chainladder result. So here, we will get the predicted values and reserve estimate for the Chain ladder model.

It’s important to note that we will just use a volume-all Chainladder (i.e. include all periods in the estimation of the development factors) and will not attempt to impose any judgement over the results. In practice, of course, models like the Chainladder are often subject to additional analysis, reasonableness tests and manual assumption selections, so it’s likely the actual result would be different, perhaps significantly, from that returned here.

At the same time, no model, whether it be the Chainladder, or a more sophisticated ML model should be accepted without further testing, so on that basis, comparing Chainladder and ML results without modification is a reasonable thing to do. Better methods should require less human intervention to return a reasonable result.

Getting the Chainladder reserve estimates#

The Chainladder reserve can also be calculated using a GLM with:

Accident and development factors

The Poisson or over-dispersed Poisson distribution

The log link.

We’ve used this method here as it’s easy to set up in R but practical work using the Chain ladder may be better done with a package like the R ChainLadder package.

The easiest way to do this is to work outside mlr3 and use the glm() function directly - this is because our mlr3 task doesn’t contain accf and devf.

Here’s the code using glm() and the predict() method to add predicted values into model_forecasts.

cl <- glm(data=dat[train_ind==TRUE, .(pmts, accf, devf)], formula=pmts ~ accf + devf, family=quasipoisson(link="log"))

model_forecasts[, "regr.glm" := predict(cl, newdata=dat[, .(pmts, accf, devf)], type="response")]

It is possible to fit this in mlr3 too - but as we need to create a new task, it’s easier to fit it directly uisng glm() as above. However, we’ve included the mlr3 code below for those who are interested. There’s a good bit more code here since we need to set up a new task and a new learner.

It isn’t necessary to run this code (we haven’t used it below) but if you do, the end result will be that it recalculates the regr.glm variable in the model_forecasts data.table.

#-------------------------------------

# create a task with the factor versions of acc and dev [accf and devf] as the only features

task_cl <- TaskRegr$new(id = "reserves",

backend = dat[, .(pmts, train_ind, row_id, accf, devf)],

target = "pmts")

task_cl$set_row_roles(dat[train_ind==FALSE, row_id], roles="validation")

task_cl$set_col_roles("row_id", roles="name")

# drop train_ind from the feature list

task_cl$col_roles$feature <- setdiff(task_cl$feature_names, "train_ind")

task_cl

#-------------------------------------

# fit the GLM - no hyper-parameter tuning since we know exactly the type of model we want to fit

lrn_glm <- lrn("regr.glm", family="quasipoisson", link="log")

lrn_glm$train(task_cl)

summary(lrn_glm$model)

#-------------------------------------

# add the predicted values to model_forecasts in the same way as we did for the other models.

model_forecasts[, lrn_glm$id := lrn_glm$predict(task=task_cl, row_ids=1:nrow(dat))$response]

<TaskRegr:reserves> (820 x 3)

* Target: pmts

* Properties: -

* Features (2):

- fct (2): accf, devf

Call:

stats::glm(formula = formula, family = structure(list(family = "quasipoisson",

link = "log", linkfun = function (mu)

log(mu), linkinv = function (eta)

pmax(exp(eta), .Machine$double.eps), variance = function (mu)

mu, dev.resids = function (y, mu, wt)

{

r <- mu * wt

p <- which(y > 0)

r[p] <- (wt * (y * log(y/mu) - (y - mu)))[p]

2 * r

}, aic = function (y, n, mu, wt, dev)

NA, mu.eta = function (eta)

pmax(exp(eta), .Machine$double.eps), initialize = expression(

{

if (any(y < 0))

stop("negative values not allowed for the 'quasiPoisson' family")

n <- rep.int(1, nobs)

mustart <- y + 0.1

}), validmu = function (mu)

all(is.finite(mu)) && all(mu > 0), valideta = function (eta)

TRUE), class = "family"), data = data)

Deviance Residuals:

Min 1Q Median 3Q Max

-24314.2 -2132.8 -165.5 2197.1 29768.4

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 10.4872 1.5323 6.844 0.00000000001614275 ***

accf2 0.1081 0.1850 0.584 0.559170

accf3 0.2943 0.1790 1.644 0.100514

accf4 0.3142 0.1783 1.762 0.078428 .

accf5 0.4975 0.1722 2.889 0.003979 **

accf6 0.3966 0.1757 2.257 0.024300 *

accf7 0.5812 0.1697 3.425 0.000648 ***

accf8 0.7639 0.1646 4.641 0.00000409939508379 ***

accf9 0.8160 0.1634 4.993 0.00000074032195234 ***

accf10 0.9134 0.1612 5.666 0.00000002087163522 ***

accf11 1.0424 0.1585 6.577 0.00000000009061906 ***

accf12 1.0535 0.1584 6.649 0.00000000005719225 ***

accf13 1.2365 0.1550 7.976 0.00000000000000573 ***

accf14 1.3824 0.1527 9.052 < 0.0000000000000002 ***

accf15 1.4433 0.1521 9.491 < 0.0000000000000002 ***

accf16 1.6146 0.1499 10.772 < 0.0000000000000002 ***

accf17 2.3237 0.1430 16.246 < 0.0000000000000002 ***

accf18 2.5606 0.1418 18.061 < 0.0000000000000002 ***

accf19 2.6943 0.1415 19.045 < 0.0000000000000002 ***

accf20 2.7579 0.1418 19.446 < 0.0000000000000002 ***

accf21 2.6739 0.1436 18.627 < 0.0000000000000002 ***

accf22 2.6984 0.1439 18.755 < 0.0000000000000002 ***

accf23 2.7328 0.1442 18.956 < 0.0000000000000002 ***

accf24 2.6458 0.1455 18.178 < 0.0000000000000002 ***

accf25 2.7457 0.1455 18.871 < 0.0000000000000002 ***

accf26 2.6922 0.1471 18.307 < 0.0000000000000002 ***

accf27 2.7095 0.1483 18.265 < 0.0000000000000002 ***

accf28 2.7077 0.1502 18.027 < 0.0000000000000002 ***

accf29 2.7094 0.1527 17.740 < 0.0000000000000002 ***

accf30 2.7414 0.1557 17.604 < 0.0000000000000002 ***

accf31 2.6494 0.1629 16.267 < 0.0000000000000002 ***

accf32 2.6256 0.1715 15.309 < 0.0000000000000002 ***

accf33 2.4901 0.1896 13.135 < 0.0000000000000002 ***

accf34 2.4785 0.2129 11.643 < 0.0000000000000002 ***

accf35 2.5877 0.2423 10.681 < 0.0000000000000002 ***

accf36 2.5514 0.3109 8.207 0.00000000000000100 ***

accf37 2.3602 0.4825 4.891 0.00000122924893227 ***

accf38 2.5342 0.7375 3.436 0.000622 ***

accf39 1.9789 1.8093 1.094 0.274424

accf40 4.9545 2.8473 1.740 0.082261 .

devf2 3.5388 1.5474 2.287 0.022480 *

devf3 4.5296 1.5342 2.952 0.003253 **

devf4 5.4969 1.5294 3.594 0.000347 ***

devf5 6.1708 1.5279 4.039 0.00005933339166295 ***

devf6 6.6198 1.5274 4.334 0.00001665091697208 ***

devf7 6.9726 1.5271 4.566 0.00000581983204682 ***

devf8 7.2391 1.5269 4.741 0.00000255053361356 ***

devf9 7.4043 1.5268 4.849 0.00000150962979881 ***

devf10 7.5380 1.5268 4.937 0.00000098014800147 ***

devf11 7.6510 1.5268 5.011 0.00000067710923359 ***

devf12 7.6877 1.5268 5.035 0.00000060002808556 ***

devf13 7.7021 1.5268 5.044 0.00000057258957465 ***

devf14 7.6716 1.5269 5.024 0.00000063396862220 ***

devf15 7.6869 1.5270 5.034 0.00000060323914182 ***

devf16 7.5844 1.5271 4.966 0.00000084691004024 ***

devf17 7.5124 1.5273 4.919 0.00000107303113279 ***

devf18 7.4058 1.5275 4.848 0.00000151766724153 ***

devf19 7.3588 1.5277 4.817 0.00000176877174392 ***

devf20 7.3692 1.5279 4.823 0.00000171603300934 ***

devf21 8.4294 1.5270 5.520 0.00000004683170363 ***

devf22 8.1591 1.5274 5.342 0.00000012242889926 ***

devf23 7.7736 1.5282 5.087 0.00000046187841181 ***

devf24 7.2492 1.5303 4.737 0.00000259778898791 ***

devf25 6.8566 1.5337 4.471 0.00000901569264533 ***

devf26 6.6937 1.5362 4.357 0.00001502151046845 ***

devf27 6.5551 1.5392 4.259 0.00002321246950917 ***

devf28 6.1211 1.5492 3.951 0.00008517947571658 ***

devf29 5.9212 1.5583 3.800 0.000157 ***

devf30 5.8001 1.5676 3.700 0.000232 ***

devf31 5.7787 1.5756 3.668 0.000262 ***

devf32 5.6027 1.5949 3.513 0.000470 ***

devf33 5.5602 1.6111 3.451 0.000590 ***

devf34 5.2985 1.6585 3.195 0.001458 **

devf35 4.7153 1.8032 2.615 0.009105 **

devf36 4.0068 2.1515 1.862 0.062949 .

devf37 5.9215 1.6695 3.547 0.000414 ***

devf38 4.4492 2.2576 1.971 0.049121 *

devf39 7.0278 1.6374 4.292 0.00002004314487218 ***

devf40 4.8165 2.9933 1.609 0.108024

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

(Dispersion parameter for quasipoisson family taken to be 29283088)

Null deviance: 362534258145 on 819 degrees of freedom

Residual deviance: 21654766145 on 741 degrees of freedom

AIC: NA

Number of Fisher Scoring iterations: 5

LASSO (regularised regression)#

Finally, we will use the LASSO to fit a model. We are going to fit the same model as we did in our previous post. We’ll include a bare-bones description of the model here. If you haven’t seen it before, then you may want to just take the model as given and skip ahead to the next section. Once you’ve read this entire article you may then wish to read the post on the LASSO model to understand the specifics of this model.

The main things to note about this model are:

Feature engineering is needed to produce continuous functions of accident / development / calendar quarters for the LASSO to fit.

The blog post and related paper detail how to do this - essentially we create a large group of basis functions from the primary

acc,devandcalvariables that are flexible enough to capture a wide variety of shapes.If we want to use mlr3 to do this, then we need to create a task that contains these basis functions as features.

Cross-validation can be done within the underlying LASSO package (glmnet) rather than via mlr3. This is what we’ve done here.

There’s a reasonable amount of code to run this model, whether we use mlr3 or not:

We need to create all the basis functions

mlr3 only - we need to set up a task

We need to train the model using glmnet’s cross-validation function,

cv_glmnet().We then need to predict using the values for a particular penalty setting (the regularisation parameter) - following the paper, we use the penalty value that leads to the lowest cross-validation error.

Since the blog post shows how to do this using glmnet directly, here we use some mlr3 code to fit the model to show how it would work in mlr3. As with the Chainladder/GLM example, it’s more efficient code-wise to do the fitting outside of mlr3.

Basis functions#

The first step is to create all the basis functions that we need. The functions below create the ramp and step functions needed (over 4000 of these!). The end result is a data.table of the original payments and all the basis functions. As noted above, all the details are in the blog post and paper.

#---------------------------

# linear spline function - used in data generation and in spline generation below

LinearSpline <- function(var, start, stop){

pmin(stop - start, pmax(0, var - start))

}

# function to calculate scaling factors for the basis functions

# scaling is discussed in the paper

GetScaling <- function(vec) {

fn <- length(vec)

fm <- mean(vec)

fc <- vec - fm

rho_factor <- ((sum(fc^2))/fn)^0.5

}

# function to create the ramps for a particular primary vector

GetRamps <- function(vec, vecname, np, scaling){

# vec = fundamental regressor

# vecname = name of regressor

# np = number of periods

# scaling = scaling factor to use

# pre-allocate the matrix to hold the results for speed/efficiency

n <- length(vec)

nramps <- (np-1)

mat <- matrix(data=NA, nrow=n, ncol=nramps)

cnames <- vector(mode="character", length=nramps)

col_indx <- 0

for (i in 1:(np-1)){

col_indx <- col_indx + 1

mat[, col_indx] <- LinearSpline(vec, i, 999) / scaling

cnames[col_indx] <- paste0("L_", i, "_999_", vecname)

}

colnames(mat) <- cnames

return(mat)

}

# create the step (heaviside) function interactions

GetInts <- function(vec1, vec2, vecname1, vecname2, np, scaling1, scaling2) {

# pre-allocate the matrix to hold the results for speed/efficiency

n <- length(vec1)

nints <- (np-1)*(np-1)

mat <- matrix(data=NA_real_, nrow=n, ncol=nints)

cnames <- vector(mode="character", length=nints)

col_indx <- 0

for (i in 2:np){

ivec <- LinearSpline(vec1, i-1, i) / scaling1

iname <- paste0("I_", vecname1, "_ge_", i)

if (length(ivec[is.na(ivec)]>0)) print(paste("NAs in ivec for", i))

for (j in 2:np){

col_indx <- col_indx + 1

mat[, col_indx] <- ivec * LinearSpline(vec2, j-1, j) / scaling2

cnames[col_indx] <- paste0(iname, "xI_", vecname2, "_ge_", j)

jvec <- LinearSpline(vec2, j-1, j) / scaling2

if (length(jvec[is.na(jvec)]>0)) print(paste("NAs in jvec for", j))

}

}

colnames(mat) <- cnames

return(mat)

}

Now the functions are defined, we’ll create a data.table of basis functions here which we’ll use later when fitting the LASSO.

The dat_plus table will hold them.

# get the scaling values

rho_factor_list <- vector(mode="list", length=3)

names(rho_factor_list) <- c("acc", "dev", "cal")

for (v in c("acc", "dev", "cal")){

rho_factor_list[[v]] <- GetScaling(dat[train_ind == TRUE, get(v)])

}

# main effects - matrix of values

main_effects_acc <- GetRamps(vec = dat[, acc], vecname = "acc", np = num_periods, scaling = rho_factor_list[["acc"]])

main_effects_dev <- GetRamps(vec = dat[, dev], vecname = "dev", np = num_periods, scaling = rho_factor_list[["dev"]])

main_effects_cal <- GetRamps(vec = dat[, cal], vecname = "cal", np = num_periods, scaling = rho_factor_list[["cal"]])

main_effects <- cbind(main_effects_acc, main_effects_dev, main_effects_cal)

# interaction effects

int_effects <- cbind(

GetInts(vec1=dat[, acc], vecname1="acc", scaling1=rho_factor_list[["acc"]], np=num_periods,

vec2=dat[, dev], vecname2="dev", scaling2=rho_factor_list[["dev"]]),

GetInts(vec1=dat[, dev], vecname1="dev", scaling1=rho_factor_list[["dev"]], np=num_periods,

vec2=dat[, cal], vecname2="cal", scaling2=rho_factor_list[["cal"]]),

GetInts(vec1=dat[, acc], vecname1="acc", scaling1=rho_factor_list[["acc"]], np=num_periods,

vec2=dat[, cal], vecname2="cal", scaling2=rho_factor_list[["cal"]])

)

varset <- cbind(main_effects, int_effects)

# drop any constant columns over the training data set

# do this by identifying the constant columns and dropping them

varset_train <- varset[dat$train_ind, ]

rm_cols <- varset_train[, apply(varset_train, MARGIN=2, function(x) max(x, na.rm = TRUE) == min(x, na.rm = TRUE))]

varset <- varset[, !(colnames(varset) %in% colnames(rm_cols))]

# now add these variables into an extended data object

# remove anything not used in modelling

dat_plus <- cbind(dat[, .(pmts, train_ind, row_id)], varset)

mlr3 setup for LASSO#

First we need to set up a task. This differs from the tree-based models task as follows in that the input variables are all the basis functions we created and not the raw accident / development / calendar quarter terms - the dat_plus data.table.

Also we don’t need to set up a cross-validation resampling for this task since the glmnet package has in-built cross-validation.

task_lasso <- TaskRegr$new(id = "reserves_lasso", backend = dat_plus, target = "pmts")

# sort out row and column roles

task_lasso$set_row_roles(dat[train_ind==FALSE, row_id], roles="validation")

# turn row_id into a name

task_lasso$set_col_roles("row_id", roles="name")

# drop train_ind from the feature list

task_lasso$col_roles$feature <- setdiff(task_lasso$feature_names, "train_ind")

Model fitting#

As noted above, the glmnet package has an inbuilt cross-validation function to fit LASSO models so we’ll use that rather than running cross validation via mlr3. We’ll use a Poisson distribution so the cross-validation will look to minimise the Poisson deviance.

The results will not be identical to those in the paper - that used 8-fold cross-validation and, even if the number of folds were the same, the random number seeds will be different, so the composition of the folds would be different.

use_pmax <- num_periods^2 # max number of variables ever to be nonzero

use_dfmax <- num_periods*10

set.seed(777) # for reproducibility

# create the mlr3 learner

lrn_cv_glmnet <- lrn(

"regr.cv_glmnet",

family = "poisson",

nfolds = 6,

thresh = 1e-08,

lambda.min.ratio = 0,

# additional parameter for mlr3 - means that the model used when predicting is the min CV error model rather than default 1se model

s="lambda.min",

dfmax = use_dfmax,

pmax = use_pmax,

alpha = 1,

standardize = FALSE,

maxit = 200000)

# train the model

lrn_cv_glmnet$train(task_lasso)

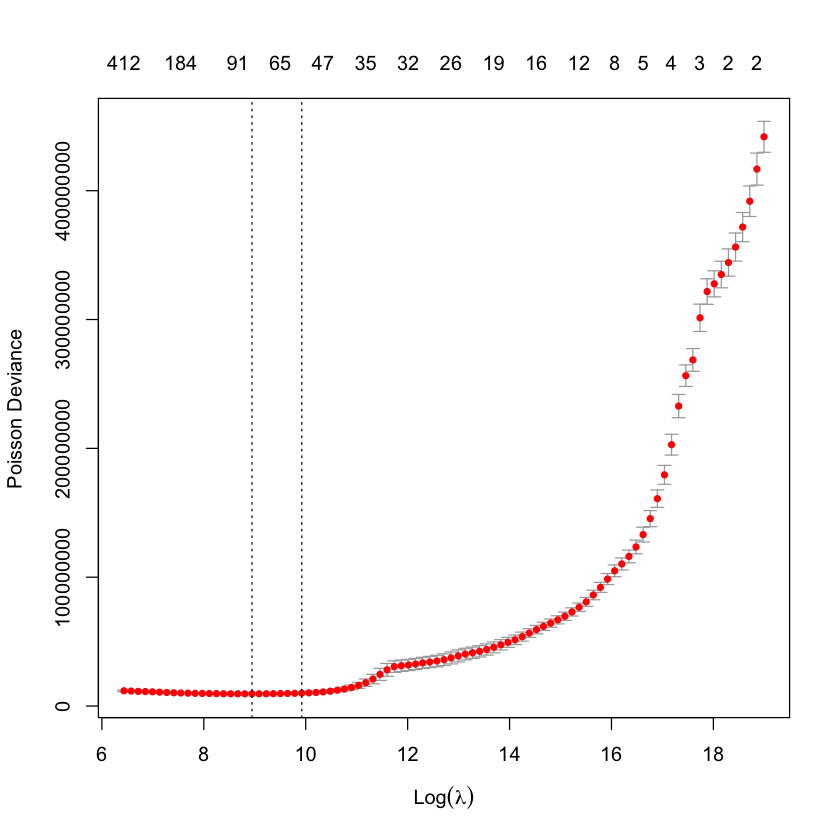

The s parameter requires a little more explanation. The regr.cv_glmnet learner (which uses the cv_glmnet() function) fits models for many different possible penalty values (termed the lambda vector). For each of these, the average error is calculated across all folds. These are then plotted (together with error bars in the special plot created when we plot a cv.glmnet results object).

# Check the path includes a minimum value of error

plot(lrn_cv_glmnet$model)

The two dotted lines in this plot represent two special penalty (or lambda values):

the

lambda.minvalue - the penalty value which has the lowest cross-validation error (the left-most dotted line)the

lambda.1sevalue - the penalty value where the cross-validation error is 1 standard error from the minimum value and the model is simpler (the right-most dotted line).

These names come from the glmnet package - cv.glmnet objects include these values. It’s important to check that a true minimum has been found - if the left-most line (the lambda.min value) is the final value where the penalty is lowest, this suggests that the lambda vector needs to be lengthened and have smaller values than the current minimum. It’s possible to supply a user-defined vector of penalty values in this case.

When working directly with glmnet we can easily access the model corresponding to any parameter value. When using regr.cvglmnet in mlr3, we need to specify which penalty value to use for predictions. By default, the mlr3 predict method uses lambda.1se, so we specify s="lambda.min" to use the lambda.min value as in the LASSO blog post.

Now we add the predictions to the model_forecasts table.

model_forecasts[, lrn_cv_glmnet$id := lrn_cv_glmnet$predict(task_lasso, row_ids = 1:nrow(dat))$response]

Model analysis#

This is the interesting bit - let’s look at all the models to see how they’ve performed (but remember not to draw too many conclusions about model performance from this example as discussed earlier!)

Before we go any further though, we will make a long version of the data set (1 model result per row) as that will make a lot of calculations easier.

data.table has a melt method for doing this. Tidyverse users may be more familiar with pivot_longer() which also does the same thing.

# get list of variables to form observations by - this is why we used a common naming structure

model_names <- names(model_forecasts)[ names(model_forecasts) %like% "regr"]

# wide -> long

model_forecasts_long <- melt(model_forecasts,

measure.vars = model_names,

id.vars=c("acc", "dev", "cal", "pmts", "train_ind"))

# rename columns

setnames(model_forecasts_long, c("variable", "value"), c("model", "fitted"))

kable(head(model_forecasts_long)) %>%

as.character() %>%

display_html()

| acc | dev | cal | pmts | train_ind | model | fitted |

|---|---|---|---|---|---|---|

| 1 | 1 | 1 | 242671.2 | TRUE | regr.rpart | 18315018 |

| 1 | 2 | 2 | 164001.3 | TRUE | regr.rpart | 18315018 |

| 1 | 3 | 3 | 3224477.8 | TRUE | regr.rpart | 18315018 |

| 1 | 4 | 4 | 3682530.8 | TRUE | regr.rpart | 18315018 |

| 1 | 5 | 5 | 10149368.6 | TRUE | regr.rpart | 18315018 |

| 1 | 6 | 6 | 28578274.7 | TRUE | regr.rpart | 18315018 |

kable(tail(model_forecasts_long)) %>%

as.character() %>%

display_html()

| acc | dev | cal | pmts | train_ind | model | fitted |

|---|---|---|---|---|---|---|

| 40 | 35 | 74 | 125261750 | FALSE | regr.cv_glmnet | 193852526 |

| 40 | 36 | 75 | 62657370 | FALSE | regr.cv_glmnet | 216713451 |

| 40 | 37 | 76 | 63467681 | FALSE | regr.cv_glmnet | 276806762 |

| 40 | 38 | 77 | 26041979 | FALSE | regr.cv_glmnet | 353563580 |

| 40 | 39 | 78 | 33947274 | FALSE | regr.cv_glmnet | 451604592 |

| 40 | 40 | 79 | 37258687 | FALSE | regr.cv_glmnet | 576831775 |

Here’s a reminder on the model names:

regr.glm- Chainladderregr.cv_glmnet- LASSOregr.rpart- decision treeregr.ranger- random forestregr.xgboostandregr.xgboost_prev- the two XGBoost models.

RMSE#

As discussed above, we are going to do these calculations manually rather than use the mlr3 benchmark tools because we want to include the Chainladder and LASSO models as well (even though we’ve fitted them here using mlr3, we used separate tasks). In any case the calculations are easy to do in data.table (for those who know that package anyway!) and it can be helpful to see what’s going on..

For those who are unfamiliar, we’ve used a feature of data.table called chaining (similar in many ways to using the %>% pipe, or the newly introduced base R pipe, |>). The code does the following:

the first line calculates

(fitted-pmts)^2for each row of the long table (the squared error contribution)the second line sums up all these contributions grouped by

modeland bytrain_ind. It also gets the count of valuesthe third line calculates the RMSE as the square root of these average contributions

model_rmse <- model_forecasts_long[, se_contrib := (fitted-pmts)^2

][, .(se_contrib = sum(se_contrib), num = .N), by=.(model, train_ind)

][, rmse := sqrt(se_contrib / num)]

head(model_rmse)

| model | train_ind | se_contrib | num | rmse |

|---|---|---|---|---|

| <fct> | <lgl> | <dbl> | <int> | <dbl> |

| regr.rpart | TRUE | 3307128991724779520 | 820 | 63506568 |

| regr.rpart | FALSE | 2864339162983414890496 | 780 | 1916306264 |

| regr.ranger | TRUE | 3609895529046446080 | 820 | 66349918 |

| regr.ranger | FALSE | 494621578124144345088 | 780 | 796322942 |

| regr.xgboost | TRUE | 803800528423931520 | 820 | 31308857 |

| regr.xgboost | FALSE | 764311151872238288896 | 780 | 989891960 |

Let’s have a look at these results separately for past and future data sets with results ranked.

Past data - train_ind == TRUE

kable_styling(

kable(model_rmse[train_ind==TRUE, .(model, num, rmse)][order(rmse),],

digits=0,

format.args = list(big.mark = ",", scientific = FALSE)),

full_width = FALSE) %>%

as.character() %>%

display_html()

| model | num | rmse |

|---|---|---|

| regr.xgboost_prev | 820 | 30,264,940 |

| regr.xgboost | 820 | 31,308,857 |

| regr.cv_glmnet | 820 | 46,966,367 |

| regr.rpart | 820 | 63,506,568 |

| regr.ranger | 820 | 66,349,918 |

| regr.glm | 820 | 138,528,927 |

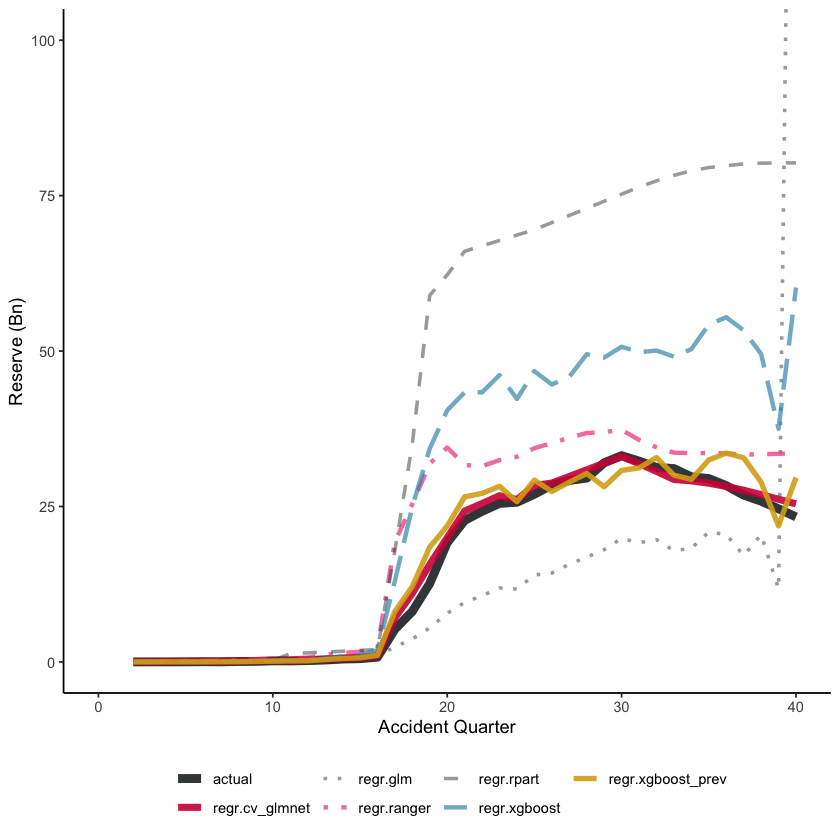

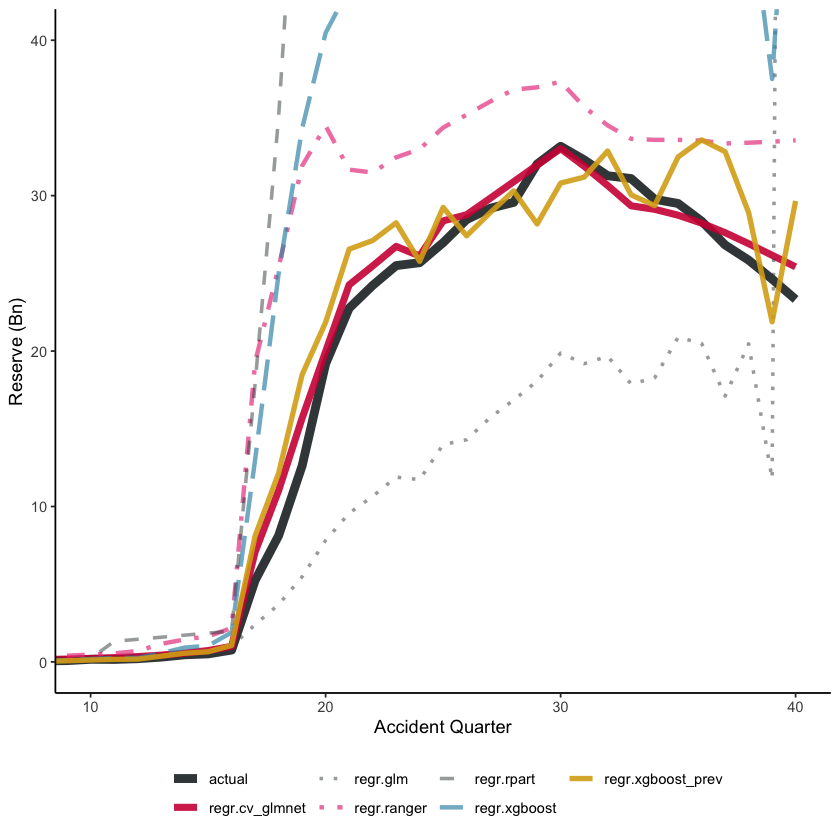

On the training data, all the tuned models perform reasonably well, with the XGBoost models having the lowest RMSE, followed by the LASSO model. Unsurprisingly, the Chainladder model (regr.glm) has high RMSE - we know that these data will not be well modelled by a Chain ladder.

However, the key indicator is performance on a hold-out data set, in this case the future data.

Future data - train_ind == FALSE

kable_styling(

kable(model_rmse[train_ind==FALSE, .(model, num, rmse)][order(rmse),],

digits=0,

format.args = list(big.mark = ",", scientific = FALSE)),

full_width = FALSE) %>%

as.character() %>%

display_html()

| model | num | rmse |

|---|---|---|

| regr.cv_glmnet | 780 | 251,388,945 |

| regr.xgboost_prev | 780 | 322,701,619 |

| regr.ranger | 780 | 796,322,942 |

| regr.xgboost | 780 | 989,891,960 |

| regr.glm | 780 | 1,722,472,390 |

| regr.rpart | 780 | 1,916,306,264 |

For the future data, we see a very different story. As expected, the tuned decision tree does appear to be over-fitted - it performs poorer than the default decision tree. The LASSO model is the best, followed by the previously tuned XGBoost model. Despite having similar hyper-parameters, the two XGBoost models perform differently.

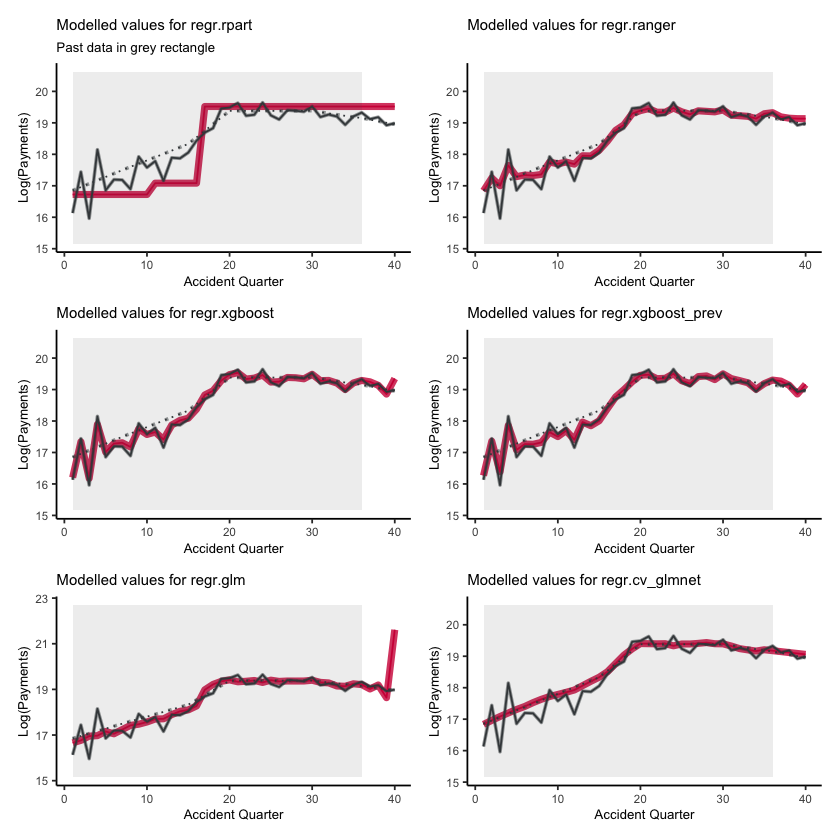

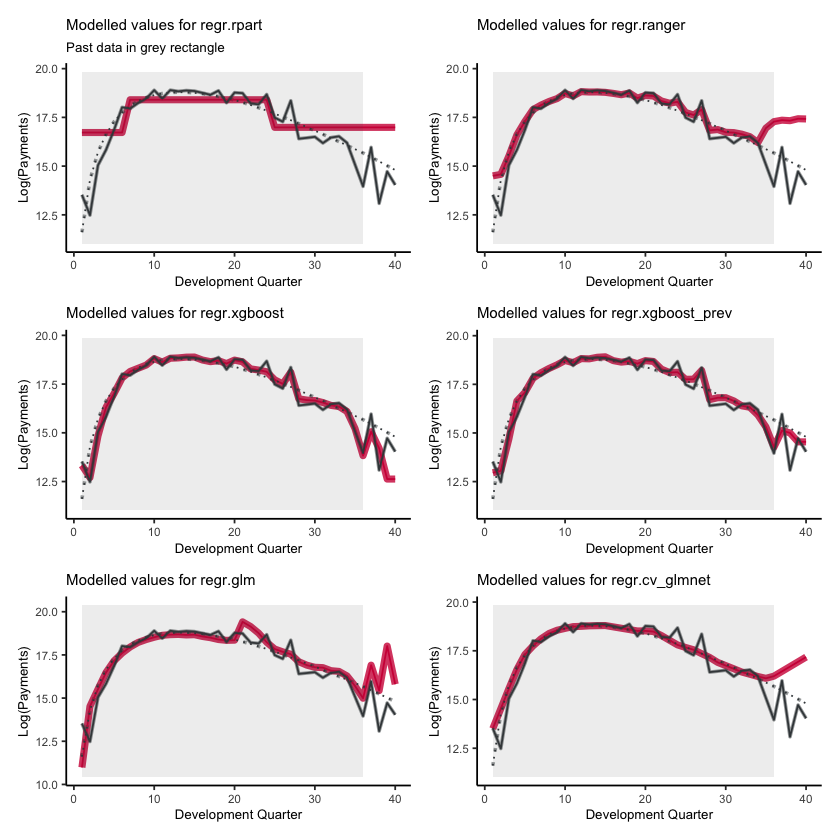

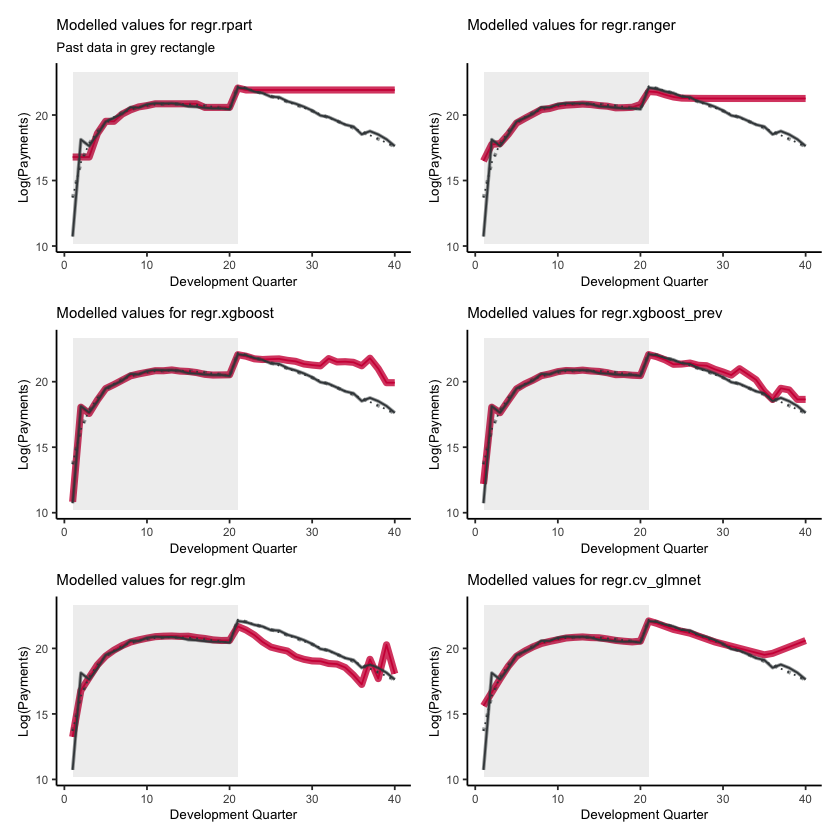

Visualising the fit#

Although useful, the RMSE is just a single number so it’s helpful to visualise the fit. In particular, because these are models for a reserving data set, we can take advantage of that structure when analysing how well each model is performing.

Fitted values#

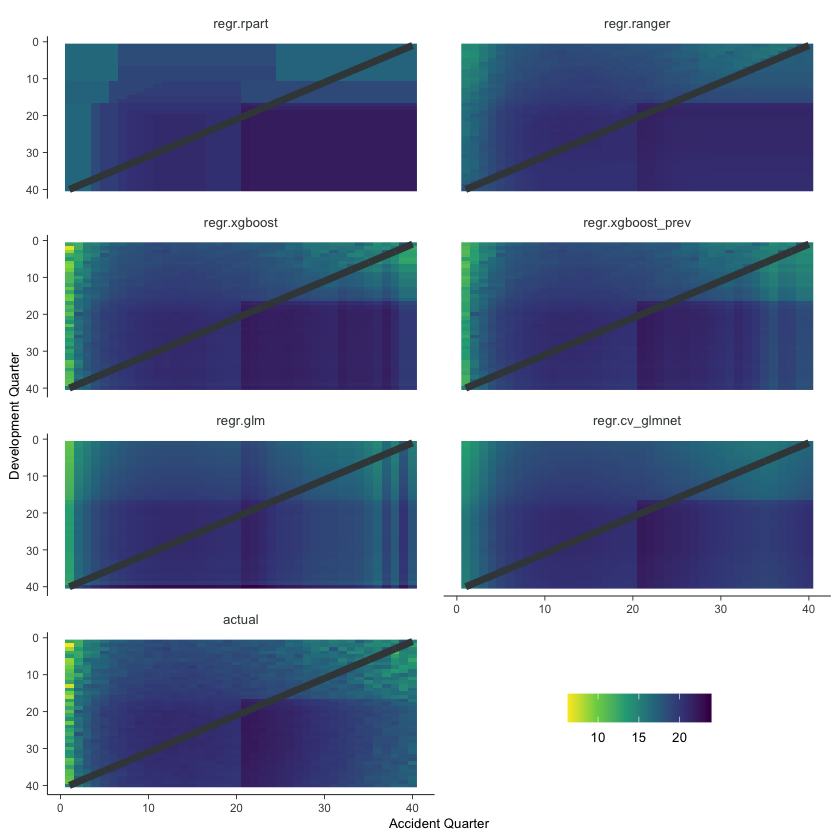

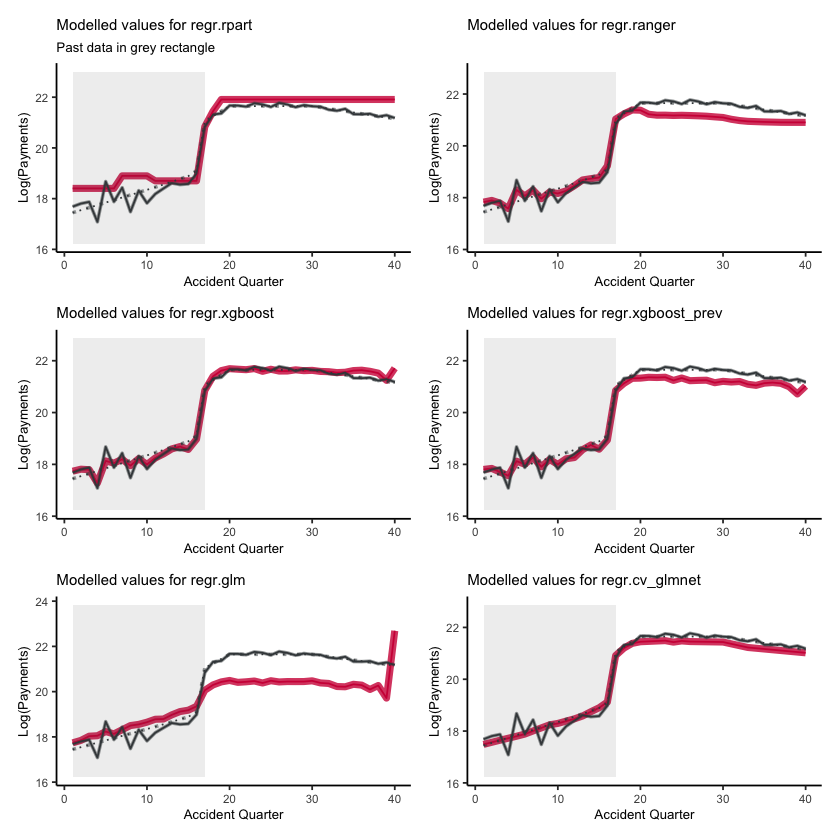

First, lets show visualise the fitted payments. The graphs below show the log(fitted values), or log(payments) in the case of the actual values.

# add in the actual values for comparison

actuals <- model_forecasts_long[model=="regr.glm",]

actuals[, model := "actual"

][, fitted := pmts]

model_forecasts_long_plot <- rbind(actuals, model_forecasts_long)

# calculate log_fitted

model_forecasts_long_plot[, log_fitted := log(pmax(1, fitted))]

# plot

ggplot(model_forecasts_long_plot, aes(dev, acc)) +

scale_y_reverse() +

geom_raster(aes(fill = log_fitted)) +

facet_wrap(~model, ncol=2)+

scale_fill_viridis_c(begin=1, end=0) +

geom_line(aes(x=num_periods+1-acc, y=acc), colour=dgrey, size=2)+

theme_classic()+

theme(strip.text = element_text(size=8,colour=dgrey), strip.background = element_rect(colour="white", fill="white"))+

theme(axis.title.x = element_text(size=8), axis.text.x = element_text(size=7))+

theme(axis.title.y = element_text(size=8), axis.text.y = element_text(size=7))+

theme(element_line(size=0.25, colour=dgrey))+

theme(legend.position=c(0.75, 0.1), legend.direction = "horizontal", legend.title=element_blank(), legend.text=element_text(size=8))+

labs(x="Accident Quarter", y="Development Quarter")+

NULL

Some things are apparent from this:

The lack of interactions or diagonal effects in the Chain ladder (regr.glm)

All the machine learning models do detect and project the interaction

The blocky nature of the decision tree (regr.rpart) and the overfit to the past data

The random forest (regr.ranger) and XGBoost fit look smoother since they are a function of a number of trees.

The LASSO fit (regr.cv_glmnet) is the smoothest, which is not surprising since it consists of continuous functions.

Visually, the LASSO seems to capture the interaction the best.

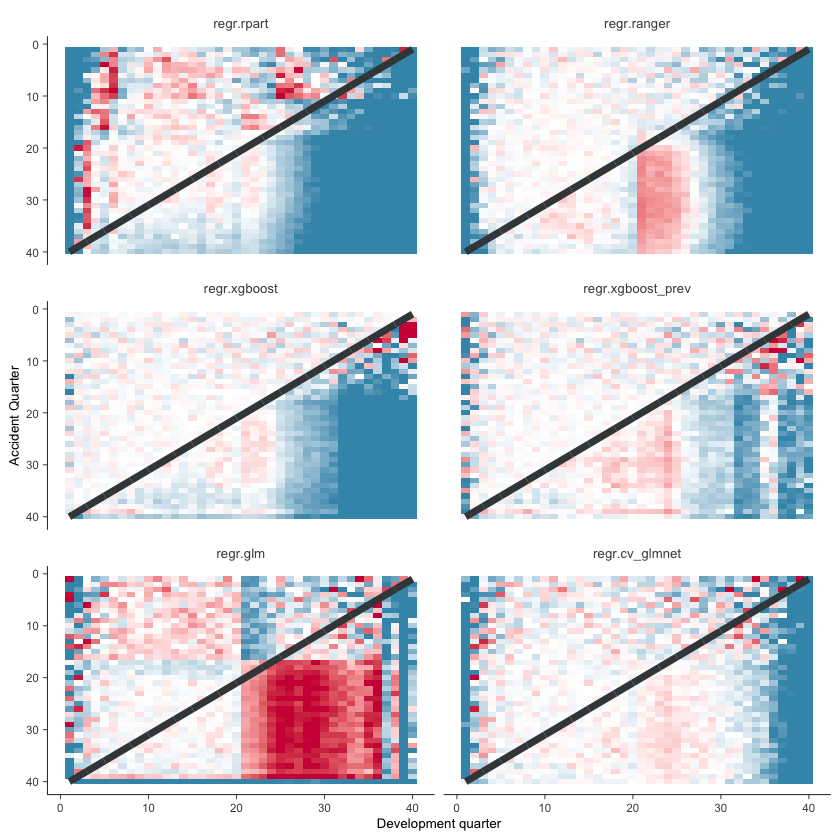

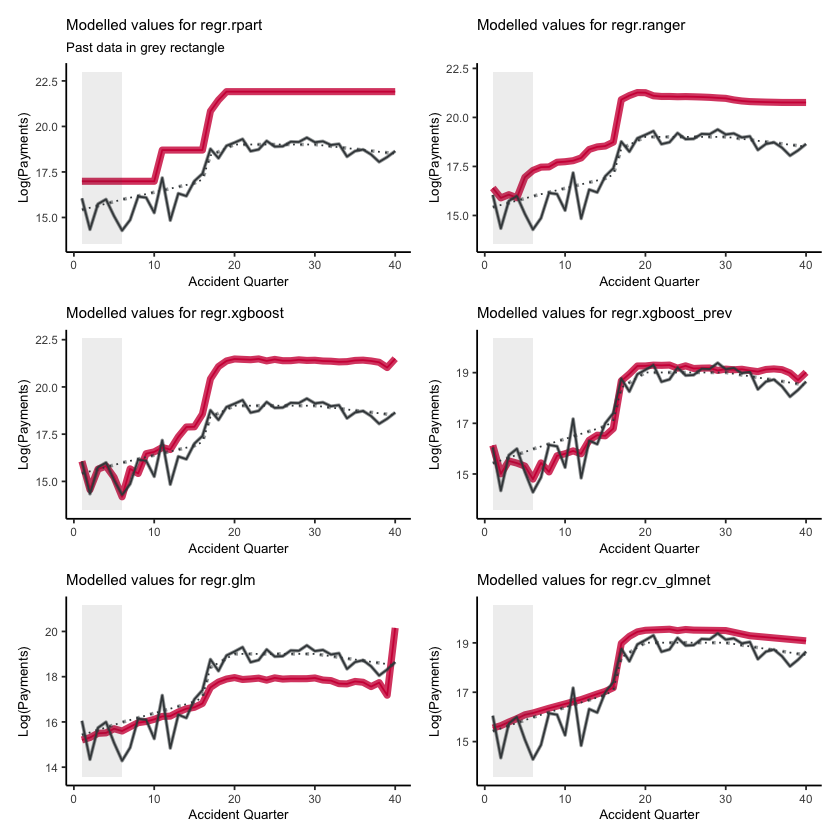

Actual vs Fitted heat maps#

We can also look at the model fits via heat maps of the actual/fitted values. The function defined below calculates the actual/fitted values, capping and collaring them at 400% and 25%. The values are then shaded so that:

Dark blue = 25%

White = 100%

Dark red = 400%

For triangular reserving data, these types of plots are very helpful when examining plot fit.

First, here’s a function to draw the heatmaps.

# heat maps

GraphHeatMap <- function(dat, x="dev", y="acc", facet="model", actual, fitted, lims=c(0.25, 4),

xlab="Development quarter", ylab="Accident Quarter"){

# copy data to avoid modifying original

localdat <- copy(dat)

# get fails if there is a variable with the same name so make local copies

local_x <- x

local_y <- y

local_actual <- actual

local_fitted <- fitted

# make restricted Avs F for heatmap and set up past/future split line

np <- max(localdat[[y]])

localdat[, .avsf := get(local_actual) / get(local_fitted)

][, .avsf_restrict_log := log(pmax(min(lims), pmin(max(lims), .avsf)))

][, .past_line := np + 1 - get(local_y)]

g <- ggplot(data=localdat, aes_string(x=local_x, y=local_y)) +

geom_tile(aes(fill = .avsf_restrict_log))+scale_y_reverse()+

facet_wrap(~get(facet), ncol=2)+

theme_classic()+

scale_fill_gradient2(name="AvF_min", low=mblue, mid="white", high=red, midpoint=0, space="Lab", na.value="grey50", guide="colourbar")+

labs(x=xlab, y=ylab)+

geom_line(aes_string(x=".past_line", y=local_y), colour=dgrey, size=2)+