Py: LLM Unstructured Text Transformation#

Leverage Large Language Models to extract structured data from free-form text for actuarial analysis

By Alice Tran

Introduction#

Actuaries increasingly encounter free-form text data across various aspects of their work. Whether it’s analyzing claim diaries that capture detailed notes about claim investigations, customer feedback from policy reviews, underwriting notes documenting risk assessments, or regulatory correspondence containing compliance-related communications, the ability to extract meaningful insights from unstructured text has become a critical skill.

Traditional approaches to text analysis often rely on keyword searches or basic sentiment analysis tools, which can miss nuanced patterns and context. Large Language Models (LLMs) offer a powerful alternative, capable of transforming unstructured text into structured data that can be used for exploratory data analysis, predictive modeling, and business intelligence.

In this tutorial, we’ll demonstrate how to use LLMs to analyze customer reviews of travel insurance policies, extracting sentiment, categorizing feedback types, and identifying specific issues. This approach can be adapted for various actuarial applications where text analysis is needed. The tutorial continues on from the previous tutorial on sentiment analysis using old natural language programming

import json

import ollama

from openai import OpenAI

import pandas as pd

from tqdm import tqdm

import matplotlib.pyplot as plt

import seaborn as sns

Setting Up the LLM Client#

The key advantage of using Ollama with the OpenAI-compatible API is flexibility. By simply changing the base_url parameter, you can switch between local and cloud-based models without changing your code structure.

When working with potentially sensitive data, privacy is a consideration. Running models locally is one approach to maintain data confidentiality. This tutorial uses Ollama with the OpenAI-compatible API, giving you the flexibility to choose between:

Local models (via Ollama): Complete data privacy, no external API calls, but requires local compute resources

Cloud-based models (via OpenAI API): More powerful models with faster processing, but data is sent to external services

For local models (Ollama):

Set

base_url='http://localhost:11434/v1'Use any model name available in your local Ollama installation

For OpenAI models:

Set

base_url='https://api.openai.com/v1'Use your actual OpenAI API key

Choose from models like ‘gpt-3.5-turbo’, ‘gpt-4’, etc.

# Initialize the OpenAI client to point to your LOCAL Ollama server

# This configuration ensures all data processing happens locally for privacy

client = OpenAI(

base_url='http://localhost:11434/v1',

api_key='ollama', # required but ignored by Ollama, can be anything

)

Configuration Parameters#

We’ll define our key parameters upfront for easy modification. The model name should correspond to a model available in your local Ollama installation. Popular choices include:

llama3.2: Good balance of performance and resource usagemistral: Strong performance on analytical tasksgemma:2b: Lightweight option for resource-constrained environments

# Configuration parameters

MODEL_NAME = 'llama3.2' # Or 'llama3.2', 'mistral', 'gemma:2b', etc.

INPUT_CSV = 'https://actuariesinstitute.github.io/cookbook/_static/daa_datasets/DAA_M07_CS2_data.csv.zip'

OUTPUT_CSV = 'reviews_with_extracted_claims_data.csv'

Data Loading and Initial Exploration#

We’ll work with a dataset of travel insurance customer reviews. This dataset is representative of the type of unstructured text data that actuaries might encounter when analyzing customer satisfaction, claim patterns, or product performance.

We’ll limit our analysis to the first 50 reviews to keep processing time manageable while still showcasing the methodology. We will also pretend the review score is not there for the purpose of this tutorial - but there is a comparison at the end.

# Load the customer review data

try:

df = pd.read_csv(

INPUT_CSV,

encoding='cp1252'

)

df = df.head(50) # Limit to 50 reviews for demonstration

df['full_review'] = df['title'] + ": " + df['body'] # Get full review text combining title and body

print(f"Loaded {len(df)} reviews from '{INPUT_CSV}'.")

print(f"Dataset shape: {df.shape}")

print(f"Column names: {list(df.columns)}")

print(f"\nSample review:\n{df['full_review'].iloc[0][:200]}...")

except FileNotFoundError:

print(f"Error: The file '{INPUT_CSV}' was not found.")

exit()

Loaded 50 reviews from 'https://actuariesinstitute.github.io/cookbook/_static/daa_datasets/DAA_M07_CS2_data.csv.zip'.

Dataset shape: (50, 7)

Column names: ['pubDate', 'rating', 'title', 'body', 'url', 'pubMonth', 'full_review']

Sample review:

Excellent value.: I used this travel insurance mainly for the car hire excess. I paid $108 for cover for a family of 5, compared to the car company excess only insurance of $200. Booking online very ...

The LLM Analysis Function: From Unstructured to Structured#

This is where the magic happens. We’ll create a comprehensive function that takes raw review text and extracts multiple structured data points:

Sentiment Classification: Positive, Negative, or Neutral

Feedback Categorization: What aspect of the service is being discussed

Specific Issue Identification: The particular event or item mentioned

The key to effective LLM prompting for actuarial applications is precision and consistency. We provide clear categories and examples to ensure reliable, standardized output that can be used for downstream analysis.

def extract_full_analysis(review_text: str) -> dict:

"""

Analyzes a review and extracts sentiment, feedback category and specific issue

as a single JSON object.

This function demonstrates how to use LLMs to transform unstructured text

into structured data suitable for actuarial analysis.

"""

# Comprehensive prompt designed for consistent, structured output

prompt = f"""

You are a senior Customer Experience Analyst. Your task is to analyze the following review

and return a single, valid JSON object and nothing else.

1. "sentiment": Classify the sentiment. Must be one of: "Positive", "Negative", or "Neutral".

2. "feedback_category": Classify the primary subject of the customer's feedback. Must be one of the following strings:

- "Product Design & Wording": Feedback on policy coverage, exclusions, price, or clarity of the Product Disclosure Statement (PDS).

- "Sales & Purchase Process": Feedback on the experience of buying the policy online or via an agent.

- "Claims Process": Feedback on the experience of submitting, managing, or the outcome of a formal claim.

- "Customer Support & Communication": Feedback on general interactions with staff via phone or email.

- "Emergency Assistance (24/7 Support)": Specific feedback on using the emergency helpline during a trip.

- "Factual Claim Notification": The customer is stating facts to lodge a claim without providing feedback on service or product yet.

3. "specific_issue": Identify the specific event or item mentioned (e.g., "flight cancellation", "lost baggage", "confusing PDS", "helpful agent"). If none, use "N/A".

Review:

"{review_text}"

JSON Output:"""

try:

# Use Ollama's chat function with JSON formatting for reliable structured output

response = ollama.chat(

model=MODEL_NAME,

messages=[{'role': 'user', 'content': prompt}],

format='json', # Ensures output is valid JSON

options={'temperature': 0} # Deterministic output for consistency

)

# Parse and return the structured response

data = json.loads(response['message']['content'])

return data

except (json.JSONDecodeError, KeyError):

# Safety net for rare cases where the output is not valid JSON

return {'sentiment': 'Error', 'feedback_category': 'Error', 'specific_issue': 'Error'}

except Exception as e:

print(f"\nAn error occurred: {e}")

return {'sentiment': 'Error', 'feedback_category': 'Error', 'specific_issue': 'Error'}

Batch Processing and Data Transformation#

Now we’ll apply our LLM analysis function to the entire dataset. This process transforms each unstructured review into three structured data points, dramatically expanding our analytical capabilities.

The tqdm library provides a progress bar, which is particularly useful when processing large datasets. The pd.json_normalize function elegantly converts the nested JSON responses into DataFrame columns.

# Apply the LLM analysis function to review sample

tqdm.pandas(desc=f"Performing analysis with {MODEL_NAME}")

# The result will be a Series of dictionaries

results_series = df['full_review'].progress_apply(extract_full_analysis)

# Use pd.json_normalize to elegantly convert the dictionaries into DataFrame columns

results_df = pd.json_normalize(results_series)

# Combine the new structured data with our original DataFrame

df = pd.concat([df.reset_index(drop=True), results_df.reset_index(drop=True)], axis=1)

print("\nFull data extraction complete.")

df.to_csv(OUTPUT_CSV, index=False)

print(f"Results saved to '{OUTPUT_CSV}'.")

print("\nSample of the final, enriched DataFrame:")

print(df[['body', 'sentiment', 'feedback_category', 'specific_issue']].head())

Performing analysis with llama3.2: 100%|██████████| 50/50 [00:42<00:00, 1.19it/s]

Full data extraction complete.

Results saved to 'reviews_with_extracted_claims_data.csv'.

Sample of the final, enriched DataFrame:

body sentiment \

0 I used this travel insurance mainly for the ca... Positive

1 We took out a cover more policy for a quick 10... Positive

2 My wife developed a medical condition so we ha... Negative

3 Prices getting more expensive as we get older ... Positive

4 needed to make a claim when I had to cut short... Positive

feedback_category \

0 Product Design & Wording

1 Customer Support & Communication

2 Product Design & Wording

3 Product Design & Wording

4 Claims Process

specific_issue

0 N/A

1 Great service

2 tricked up Insurance Policy

3 Prices getting more expensive as we get older

4 N/A

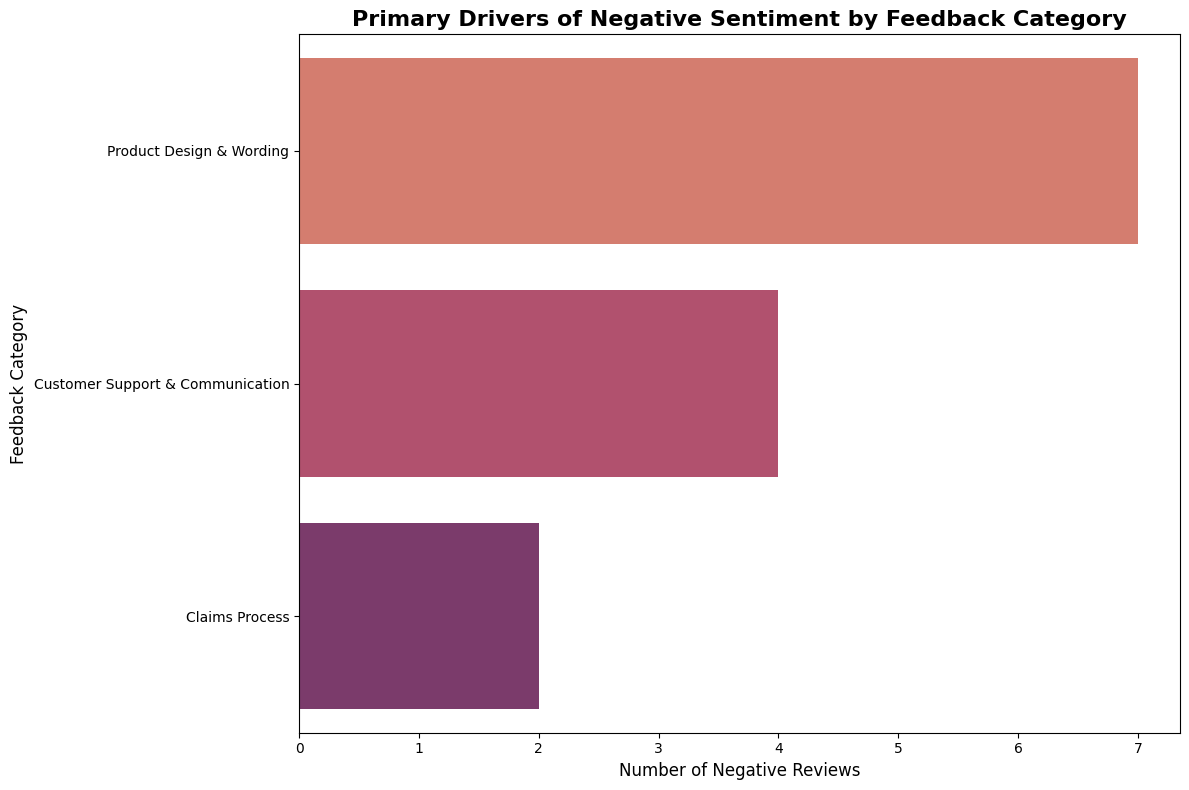

Root Cause Analysis: Identifying Key Issues#

With our text data now structured, we can perform analysis to identify patterns and root causes - and look to understand:

Risk factors: What issues lead to claims or customer dissatisfaction?

Process improvements: Where are the bottlenecks in customer experience?

Product development: What features or coverage gaps need attention?

We’ll focus on negative reviews to identify the primary drivers of customer dissatisfaction.

# Filter to focus on negative reviews for root cause analysis

negative_df = df[df['sentiment'] == 'Negative'].copy()

print(f"\n--- Root Cause Analysis for {len(negative_df)} Negative Reviews ---")

print(f"Negative sentiment rate: {len(negative_df)/len(df)*100:.1f}%")

if negative_df.empty:

print("No negative reviews were found to analyze.")

else:

# Display distribution of feedback categories in negative reviews

print("\nBreakdown of negative feedback by category:")

print(negative_df['feedback_category'].value_counts())

--- Root Cause Analysis for 13 Negative Reviews ---

Negative sentiment rate: 26.0%

Breakdown of negative feedback by category:

feedback_category

Product Design & Wording 7

Customer Support & Communication 4

Claims Process 2

Name: count, dtype: int64

Primary Drivers of Negative Sentiment by Category#

This visualization helps identify which aspects of the travel insurance service are causing the most dissatisfaction. For actuaries, this information is crucial for:

Risk assessment: Understanding which processes have the highest failure rates

Resource allocation: Prioritizing improvement efforts where they’ll have the most impact

Product pricing: Factoring in customer experience risks to pricing models

if not negative_df.empty:

# Analysis 1: Primary drivers of negative sentiment by feedback category

plt.figure(figsize=(12, 8))

sns.countplot(data=negative_df, y='feedback_category',

order=negative_df['feedback_category'].value_counts().index,

palette="flare")

plt.title('Primary Drivers of Negative Sentiment by Feedback Category',

fontsize=16, fontweight='bold')

plt.xlabel('Number of Negative Reviews', fontsize=12)

plt.ylabel('Feedback Category', fontsize=12)

plt.tight_layout()

plt.show()

print(f"\nTop negative feedback category: {negative_df['feedback_category'].value_counts().index[0]}")

print(f"This represents {negative_df['feedback_category'].value_counts().iloc[0]} out of {len(negative_df)} negative reviews")

<ipython-input-8-6cff36d9f359>:5: FutureWarning:

Passing `palette` without assigning `hue` is deprecated and will be removed in v0.14.0. Assign the `y` variable to `hue` and set `legend=False` for the same effect.

sns.countplot(data=negative_df, y='feedback_category',

Top negative feedback category: Product Design & Wording

This represents 7 out of 13 negative reviews

Specific Issues Driving Negative Sentiment#

While categories tell us the general area of concern, specific issues may provide actionable insights. We can sample a few specific issues to look for operational failure points or customer journey pain points.

if not negative_df.empty:

# Analysis 2: Specific issues driving negative sentiment

# Filter out 'N/A' values and get top issues

specific_issues = negative_df[negative_df['specific_issue'] != 'N/A']['specific_issue'].value_counts()

if not specific_issues.empty:

from IPython.display import display

# Show top 10 specific issues

top_issues = specific_issues.head(10)

display(top_issues)

specific_issue

tricked up Insurance Policy 1

lost baggage 1

broken surfboard 1

Corona virus coverage 1

family policy exclusion 1

incorrect birth dates on certificate 1

delayed claim processing and lack of support 1

Policy interpretation and lack of clarity 1

poor service 1

unhelpful agent 1

Name: count, dtype: int64

Summary and Next Steps#

This tutorial has demonstrated how LLMs can transform unstructured text data into structured insights valuable for actuarial analysis. We converted free-form reviews into structured sentiment, category, and issue data. The code optionally uses local LLM processing to maintain data confidentiality. With the structured data, one can identify primary drivers of customer dissatisfaction and potentially find actionable insights.

The overall approach is generalisable - and may have other applications for actuaries - for example:

Claim Analysis: Extract patterns from claim diaries and adjuster notes

Underwriting Risk Assessment: From freeform underwriting notes

Product Development: Understand coverage from products of the business and its competitors

Customer Experience: Quantify service quality impacts on retention and satisfaction

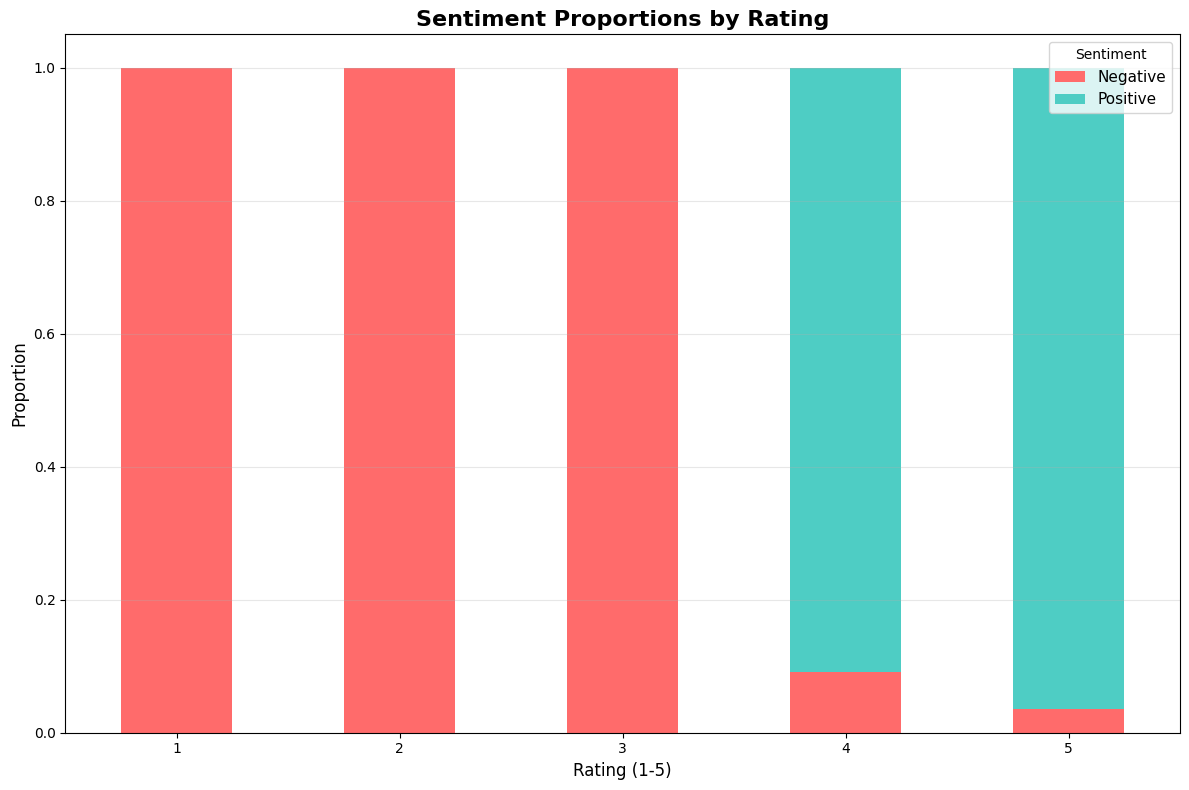

Additional Analysis: Sentiment Distribution#

Let’s conclude with an overall view of sentiment distribution across the reviews to see how the LLM has fared in reading the text compared to the true review score.

# Overall sentiment distribution

# Create the stacked bar chart showing proportion of sentiments within each rating

plt.figure(figsize=(12, 8))

# Calculate sentiment proportions by rating

rating_sentiment_props = df.groupby('rating')['sentiment'].value_counts(normalize=True).unstack().fillna(0)

# Create the stacked bar chart

rating_sentiment_props.plot(kind='bar', stacked=True,

color=['#ff6b6b', '#4ecdc4', '#45b7d1'],

figsize=(12, 8))

plt.title('Sentiment Proportions by Rating', fontsize=16, fontweight='bold')

plt.xlabel('Rating (1-5)', fontsize=12)

plt.ylabel('Proportion', fontsize=12)

plt.legend(title='Sentiment', fontsize=11)

plt.xticks(rotation=0)

plt.grid(axis='y', alpha=0.3)

plt.tight_layout()

plt.show()

<Figure size 1200x800 with 0 Axes>

It appears the LLM reading of the reviews is fairly consistent with the sentiment distribution.

This tutorial demonstrates how by leveraging LLMs to structure unstructured data, actuaries can unlock new insights from text sources that were previously difficult to analyze systematically.